Bank Branch Risk Assessment

Bank Branch Risk Assessments Software & Tools

Assess risks across each of your enterprise’s branches with LogicManager’s all-in-one Bank Branch Risk Assessment solution. Use a risk assessment to easily identify bank risk themes across your branches as well as gaps in controls and processes. It’s also important to gain insight into location-specific risk factors (like susceptibility to natural disaster, number of employees or departments, etc.) to truly understand your risks on an enterprise level.

This application can be achieved through:

Why a Risk-Based Approach to Branch Assessments is important:

LogicManager’s Branch Risk Assessment Solution

- Surface risk insights and concerns from your frontline managers through our standardized Bank Branch Risk Assessment to ensure better resource allocation.

- Customize the LogicManager home screen to bring your end users directly to their branch risk assessment tasks to ensure they’re completed in a timely manner.

- Our comprehensive Risk Library, organized by common root-cause sources of bank branch risks, helps you design controls that more effectively mitigate systemic risks.

- Using our Enterprise Heatmap, create visualizations on which branches need additional resources or auditing to strengthen the overall enterprise.

- Use LogicManager’s Control & Control Suggestions feature to break down silos and automatically leverage existing entity controls or controls from other branches to make your program more efficient.

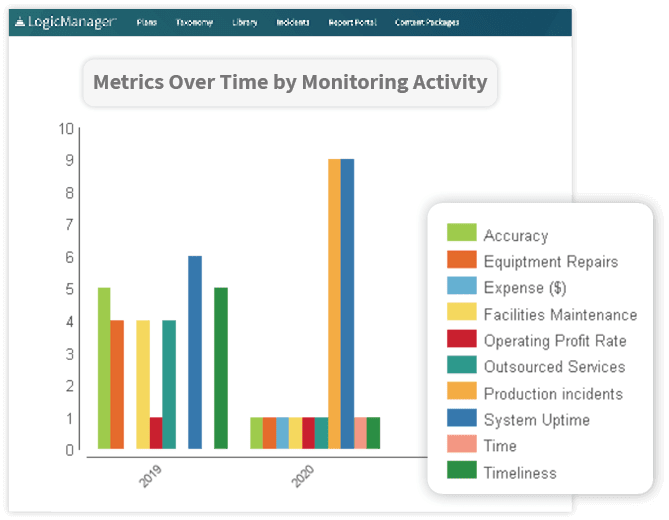

- Experience a robust Reporting & Dashboards system that makes it easy to drill into data such as branches with the most critical risks, location-specific risk factors and much more.

COMPLIMENTARY DOWNLOAD:

5 Steps for Better Risk Assessments – Financial Edition

5 Steps for Better Risk Assessments – Financial Edition

Conduct Branch Assessments with LogicManager

Centralized risk library

LogicManager’s out-of-the-box bank risk library will benefit your organization by uncovering dependencies across departments and branches while also standardizing the language across your entire organization. This gives teams an approachable starting point to complete their risk assessments.

Manage controls with purpose

Create and maintain your control repository with strategic bank goals in mind. This can be done easily since all of your branches and departments have the ability to reference what other locations are doing to control risk.

What is a Bank Branch Risk Assessment?

The hallmark of a healthy enterprise risk management (ERM) system is the ability to assess risk in a uniform fashion. This is especially true for financial institutions today, who must evaluate compliance risks (i.e. BSA/AML, FFIEC, etc.) more frequently than ever as a result of recently increased regulatory scrutiny and penalties.

If you’re a bank with multiple branches, each branch is representative of your entire bank ecosystem. You wouldn’t want the misstep of one to affect your entire organization’s reputation. That’s why it’s even more important to consider each of your branch risks as your own, and standardizing this process across the board can help streamline your procedures tremendously and set your entire business up for success.

Having a standardized, automated process in place sets you up repeatedly for annual risk assessments or risk assessments that are performed as a result of an event like a merger or acquisition. As a financial institution, taking a risk-based approach and standardizing your risk assessment program is also critical in identifying the overlapping activities that crowd your program, prioritizing actions and empowering your branches to make more informed decisions.

Bank Branch Risk Assessment Risks

Conducting branch risk assessments is an essential part of your ERM program. When your ERM program falls short, risks that once posed minimal threat to your organization can quickly snowball. Failure in critical ERM processes like risk assessments can lead to a rating downgrade or warning flag or business continuity failures and product liability issues.

Without a complete ERM program, you’ll be left without evidence to prove you were not negligent. Considering the fact that regulatory penalties, fines and shareholder value decline can add up, it’s important for any financial institution to prevent risk management deficiencies wherever possible — and it all starts with better risk assessments. This will allow them to achieve regulatory compliance.

On a more immediate scale, failure in branch risk assessment can lead to the following consequences:

- Lack of Continuity: Changes in the organization or development of new business lines may result in new activities even though existing ones are more effective.

- Lack of Coordination: Often, activities apply to multiple risks or commitments across functional lines. The inability to formally tie activities to risk or commitments hinders inter-functional coordination, resulting in business silos and duplication of effort.

- Activity Fatigue: Staff may ignore certain activities because of a lack of time to assess them.

- Wasted Resources: If a risk changes, most branches would have no way of knowing how (or even if) these changes will affect their resources and activities.

- Activity Obsolescence: In a changing environment, there is no effective way to know when activities no longer apply.

- Lack of Prioritization: Picking activities to focus on is likely to be on an ad hoc basis and subject to the whims of current staff.

Frequently Asked QuestionsAbout Bank Branch Risk Assessment

An internal audit for banking examines a financial institution’s accounting processes and corporate governance. This process seeks to ensure the institution complies with regulations and laws. An internal audit also makes sure that a bank has timely and accurate financial reports. Through an internal audit, the management team gets the data and tools needed to achieve operational efficiency while identifying and fixing problems before an external audit detects them.

An internal audit can act as a risk management tool that protects a bank against fraud, abuse or waste. Usually, the results of an audit include recommendations for process improvements.

Checking for risks of all levels is critical during a bank branch risk assessment. The internal audit measures the total number of threats present and their potential impact on your institution based on categories like transactions, products, customers, employees, services and locations. The assessment should also account for fraud risk and regulatory compliance requirements.

When conducting a risk assessment, sort each risk into a category, such as products and services, location and customer risks. Then, rank the risks based on their potential effect on your institution. For example, some areas present risks due to a higher prevalence of crimes, or insufficient staffing at the branch may result in customer complaints.

Your financial institution can prepare for an internal audit in several ways. The first step is to determine who will serve on the audit committee. Depending on the size of your institution, you may employ internal auditors or outsource the role. Bank employees in other positions may also serve on the internal audit committee, too.

The next step is to prepare a list of risks or threats to your institution and to rank those by threat level. It’s also essential to have a goal for the audit. When preparing, consider what your financial institution wants to get out of the audit and the steps required to achieve those goals.

Allow plenty of time for the audit. Often, the process can take about one year. If you know an external audit is coming up, it’s best to have the internal audit finished before the external begins so you can implement any recommendations for improvement.

Request a DemoLearn How LogicManager’s Bank Branch Risk Assessment Software Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.