Environmental, Social, and Governance (ESG)

Protect Your Reputation with ESG Software

Companies are being pressured by the See-Through Economy to determine how they can justify ESG status and sustain their disclosures from the SEC’s scrutiny on misstatements. However, many people are struggling to find a way to achieve ESG and sustainability in a meaningful way (that is, going beyond saying “we recycle”).

Having a strong Enterprise Risk Management program in place helps you inherently satisfy ESG requirements by promoting good governance in your everyday activities.

Why Taking a Risk-Based Approach to ESG is Important:

How LogicManager’s ESG Software Helps

- Personalize LogicManager home screens to display your users’ most important data (e.g. policies that support an ESG framework, readiness dashboards, sustainability reports, etc.) to help streamline the complex process of gathering data for your disclosures.

- Our standardized ESG Risk Assessment allows you to engage with your front line to gather intel on processes and procedures that could potentially jeopardize your ESG status so you can proactively mitigate risk.

- Complete a Readiness Assessment to see exactly where you stand against requirements for ESG standards (e.g. the CDP, CDSB, GRI, SBTi, TCFD, PRI or WEF Stakeholder Capitalism Metrics) and forge the most direct path for achieving compliance.

- Automatically collect KRIs, KPIs & Metrics to prompt any additional monitoring and gain a unified, evidence-based way of tracking and measuring your ESG goals.

- Through our Event Management functionality, tie any issue or finding uncovered during your disclosure process directly to the risks, vendors, policies or controls that it’s associated with to uncover root cause and prevent recurrence.

- Use our Resource Management tools to collect due diligence on your vendors’ supplier questionnaires, DEI practices, environmental standards or otherwise to build context around their impact on your ESG program.

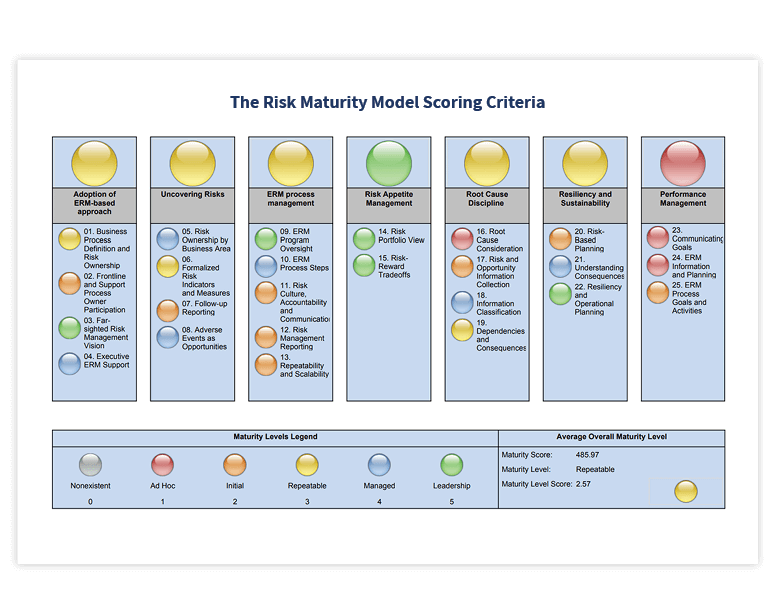

- Take our industry-standard Risk Maturity Model to reveal how committed you are to making better business decisions and therefore how aligned you are with standards of ESG.

- Use our Reporting & Dashboards system to visualize where ESG data is housed, automate your ESG disclosure process and build sustainability reports all within one centralized location.

What is Environmental, Social and Corporate Governance? (ESG)

Environmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments.

- Environmental criteria consider factors such as carbon emissions, water and waste management, raw material sourcing, and climate change vulnerability and mitigations.

- Social criteria examine diversity, equity, and inclusion, labor management, data privacy and security, and community relations where it operates.

- Governance criteria deals with a company’s leadership, executive pay, audits, internal controls, board governance, business ethics, intellectual property protection, and shareholder rights.

Complete Guide: What is ESG?

Why is ESG so important?

As investors place an increasing amount of priority on ESG, the more material this information has become to a firm’s value and financial picture. Company disclosures have come under recent scrutiny with a governance and control framework advocated to provide assurance for ESG reporting and sustainability management controls.

On March 3, 2021, the SEC Division of Examinations issued its priorities for 2021, which indicated a renewed focus on ESG matters, including whether examined firms’ practices match their website and 10-K disclosures. Disclosures and statements of an organization’s ESG principles and reporting programs require the implementation of an efficient and unified evidence-based way to track, measure, attest, and report on their ESG goals, initiatives, and results.

Recent findings provide evidence that companies highly rated in terms of their Environmental, Social, and Governance (ESG) score report higher excess returns and lower volatility. This is supported by the assumption that ESG factors are considered important by market agents as good proxy for firms’ financial soundness in risk management.

Find Out More: Why Is ESG Important?

ESG Risks

The See-Through Economy

Today, we exist in a world where consumers and investors want to align themselves with companies whose values they agree with. If you claim that you have a high ESG performance and then actually aren’t, this is a huge reputation risk and something that your customers and investors will take note of.

Negligence

In your 10K and 10Q, there is a risk that the person making the disclosure isn’t actually aware of all of the risks they are claiming. Without ensuring that this person has confidence in what they are disclosing, even if they don’t know, they are still signing off on it and will face the penalties of negligence.

Fraud

If you misrepresent your company with ESG data, as an ESG company to investors then you will get more investors, and your stock will go up artificially. This is fraud, and you run the risk of fines, penalties, lawsuits, or worse.

Customer loss

If you can’t define meaningful ways that your company is ESG, for many people, it’s difficult to support your business. This can lead to a loss of consumer and investor buy-in.

Importance of ERM for ESG

Recent findings show that by having good ERM practices, you are a company with good ESG practices.

If you have a strong risk management program, you inherently have ESG management, ESG Data, and ESG reporting embedded into every aspect of your company. The more you are committed to making better business decisions and getting strong business results, the more you align your organization with the standards of ESG. Simply put: to have a strong risk management program, you need to be a responsible company.

An effective ESG program requires collaboration, insight, and metrics from across the organization to work towards common goals as a team. Many organizations start with an ESG risk and readiness assessment. Another way to measure yourself against these best practices is through our Risk Maturity Model, which has proven to help companies achieve up to 25% higher market valuations. LogicManager provides certification and evidence-based statements that can be disclosed with confidence on SEC documentation.

Frequently Asked Questions

What Is ESG Software?

ESG Software is a type of software designed to help organizations manage and measure their environmental, social, and governance (ESG) performance. ESG data can be used to make better decisions about where to allocate resources, how to respond to emerging risks, and what policies or practices to put in place.

Why Is ESG Software Important?

It is important to utilize ESG software because it can help organizations become more sustainable and efficient. Additionally, ESG data is becoming increasingly important to investors, who want to know how a company is performing not just financially, but environmentally and socially as well.

What Are Some Features Of ESG Solutions?

Within ESG Software you will find features that are designed to help with the management and measurement of an organization’s ESG performance. This will include data collection, analysis, and reporting tools. Additionally, it is commonplace to see features such as scorecards or dashboards that provide a snapshot of an organization’s progress.

Request a DemoLearn How LogicManager’s ESG Software Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.