Enterprise Risk Management

Performance is the result of effective risk management

Our enterprise risk management (ERM) platform empowers organizations to anticipate what’s ahead, protect their reputation, and improve business performance through strong governance. Our all-in-one hub streamlines your processes with a range of automated tools that allow for better risk identification, monitoring, and reporting. Developing, improving, and reporting on your risk program has never been easier with our ERM software solutions.

- Leverage prebuilt libraries to identify high-impact risks and allocate resources accordingly with objective risk assessments.

- Engage the right people at every step of your risk program with easily accessible to-do lists using automated task notifications.

- Eliminate static spreadsheets with centralized data accessible through flexible integrations with your existing data administration applications.

- Robust reporting capabilities, ensuring up-to-date and easily accessible data synthesized with reporting templates for operational and board reporting.

Why Logicmanager? – Users of LogicManager’s ERM software explain how their risk management programs have benefited from our platform and expert advisory service.

Customer Success StoriesExplore How Companies Overcame Challenges With Our ERM Software Platform

Georgia Farm Bureau Mutual Insurance Company® Case Study

Georgia Farm Bureau Mutual Insurance Company® transformed the reputation and value-add of their risk management department by leveraging LogicManager’s software.

Regulatory Challenges and Enterprise Risk Management Case Study

How one of LogicManager’s customers in the financial services industry has used LogicManager to manage regulatory challenges with a best practice Enterprise Risk Management program.

What Our Customers Are Saying...

The LogicManager DifferenceA Holistic Approach to Enterprise Risk Management (ERM)

Business Decision InsightsFocus on What’s Important

Through our ERM platform, we allow our customers to spend more time strategically managing risks– and less time on tedious administrative activities, like data cleansing and manipulation. Our solution enhances efficiency while bringing “unknown knowns” that risk managers might miss to the surface. Our risk management tools are designed to help you align strategic business goals with operational objectives. By giving you an enterprise view of your risk at all times, LogicManager not only drastically reduces the time and money you spend on risk management, it helps you help others.

Customer ExperienceStreamline Your Risk Management Program

Unlike other software that requires IT professional customization, our solution allows customers to control engagement through an end-user configuration. This approach enables faster time-to-value and allows organizations to evolve their programs over time, not to mention a quicker return on investment.

Risk-Based ApproachPrepare for Tomorrow’s Surprises Today

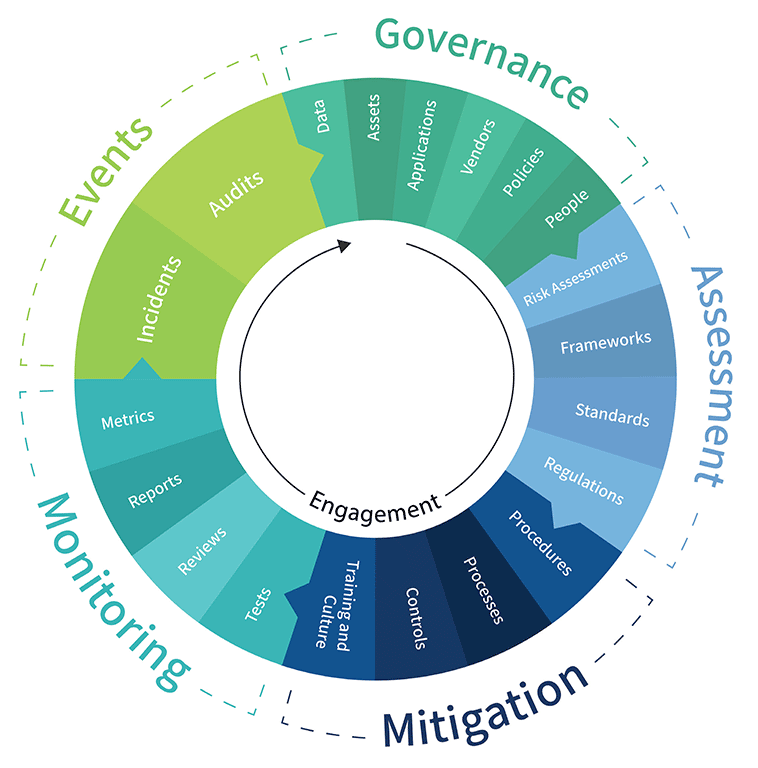

A risk-based approach is the key to effective governance, risk, and compliance. This process enables sound prioritization across organizational silos, identifies challenges and critical dependencies, and proper resource allocation. LogicManager’s risk management platform guides you through the process steps of a risk-based approach from start to finish: identify, assess, mitigate, monitor, and report.

CapabilitiesAn All-In-One Enterprise Risk Management Platform

ERM Solutions to Bridge Your Risk Journey Across Silos

Your risks are all interconnected. Our governance area and point solution packages are built on a taxonomy platform, so they can be easily integrated into any department and support you throughout the entirety of your organization’s risk journey.

Frequently Asked QuestionsFoundations of Enterprise Risk Management

Enterprise Risk Management (ERM) software helps you take an enterprise-wide approach to risk management and compliance. Your risk and compliance programs are all connected, so they should be managed using software that inherently draws connections between the people, processes, and departments at your organization that house those risks and ladder up to various regulations. ERM software serves as a centralized hub for managing risk across your entire enterprise.

Managing your risk is crucial in today’s See-Through Economy, where consumers and investors have access to more information than ever before, which can impact a company’s reputation. By using ERM software, organizations can streamline their risk management and compliance efforts, automate manual processes, and provide robust reporting capabilities, making it easier to identify trends and communicate risk-related information to stakeholders. ERM software also helps organizations allocate resources effectively, prioritize risks, and make informed decisions based on a holistic view of their risks.

Enterprise risk management (ERM) is a systematic approach to managing risks across an entire organization. It involves identifying, assessing, mitigating, monitoring, and reporting on risks that could impact the organization’s objectives, stakeholders, and operations. ERM provides a holistic view of all the risks that an organization faces and allows it to prioritize and allocate resources to manage those risks effectively.

The goal of ERM is to help organizations anticipate and manage future financial, operational, and regulatory risks, as well as mitigate lawsuits and penalties. By using a risk-based approach, companies can identify and prioritize the risks that pose the greatest threats to their business, and then take action to address them.

ERM involves a range of activities, such as risk assessments, risk mitigation strategies, monitoring and reporting on risks, and ongoing risk management. It is a continuous process that requires engagement from stakeholders at all levels of the organization, including executives, managers, employees, and external partners.

Overall, enterprise risk management helps companies protect their reputation, employees, investors, and community by enabling them to allocate resources effectively and make informed decisions that take into account the potential impact of risks on their business.

Not only does having a strong risk management program save you money, but it also enhances performance. In fact, organizations that have a formalized enterprise risk management program tend to have higher evaluations thanks to their risk analysis.

An independent research study, “The Valuation Implications for Enterprise Risk Management Maturity,” was published in the prestigious Journal of Risk and Insurance. This peer-reviewed and rigorous study conducted by Queens University MBA program definitively quantifies a 25% market valuation premium for organizations that have reached mature levels of ERM.

Implementing an effective risk management program is best done through a risk-based approach which is a five-step process:

- Identify

- Assess

- Mitigate

- Monitor

- Report

The first step in the risk management process is to identify the risks that are likely to occur. The company will need to identify the risks related to its business by conducting a risk assessment based on surrounding areas that could potentially affect them. Download this complimentary risk assessment template built on a framework of best practices to get started.

Every governance area consists of a host of different events, governance, assessment, mitigation, and monitoring activities that must be carried out in order to truly protect your organization. Enterprise risk management is most effective as an iterative process in which each activity builds off the other. Most importantly, the key to navigating this complexity is engaging people across all levels and departments of the organization.

To help organizations across industries achieve this goal, LogicManager authored the Risk Maturity Model (RMM) in 2005. The RMM was launched as a best practice framework and free risk maturity assessment tool. Today, the RMM is housed directly within the LogicManager application and continues to help professionals and executives develop and improve sustainable enterprise risk management programs.

Take the free RMM assessment here.

Related PackagesYou May Also Like…

Request a DemoLearn How LogicManager’s ERM Software Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.