Model Risk Management

Protect Your Reputation with Model Risk Management Software

LogicManager’s Model Risk Management Software empowers organizations to better identify and assess model risk, record the review and validation process, and consolidate relevant policies and regulations in one place. Mismanagement of model risks can lead to dramatic financial losses, misinformed business decisions, and damage to your organization’s reputation. With our risk-based approach, you will be able to address your model risks in order of operational criticality.

- Create a centralized repository of the models that are being used within your organization

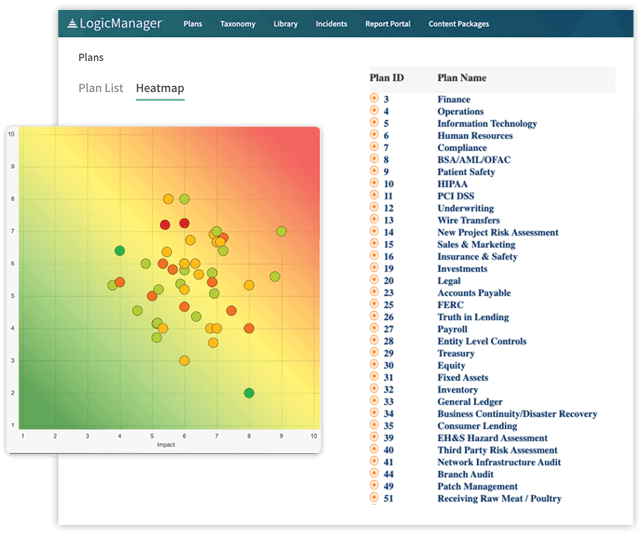

- Identify the most critical risks across your enterprise with out-of-the-box, editable, and objective risk assessments

- Provide overarching model risk governance and automate workflows to engage the proper stakeholders for reviews, approval steps, and validation

- Manage issues and findings within a risk-based system that allows you to associate events with the associated risks, people, policies, procedures or controls to tie issues to their root cause and prevent repeat occurrences

- Use our robust Reporting & Dashboards provide relevant model risk management data to stakeholders and leadership to inform and deliver better business decision making

Why Logicmanager? – Users of LogicManager’s ERM software explain how they have benefited from our platform and expert advisory service.

Customer Success StoriesExplore How Companies Overcame Challenges With Our ERM Solution

Georgia Farm Bureau Mutual Insurance Company® Case Study

Georgia Farm Bureau Mutual Insurance Company® transformed the reputation and value-add of their risk management department by leveraging LogicManager’s software.

Regulatory Challenges and Enterprise Risk Management Case Study

How one of LogicManager’s customers in the financial services industry has used LogicManager to manage regulatory challenges with a best practice Enterprise Risk Management program.

What Our Customers Are Saying...

The LogicManager DifferenceA Holistic Approach to Model Risk Management

Business Decision InsightsFocus on What’s Important

Through our ERM software, we enable our customers to allocate more time to strategic risk management, reducing their involvement in tedious administrative activities like data cleansing and manipulation. Our solution enhances operational efficiency while uncovering the “unknown knowns” that risk managers may overlook, thus ensuring proactive identification and mitigation of risks.

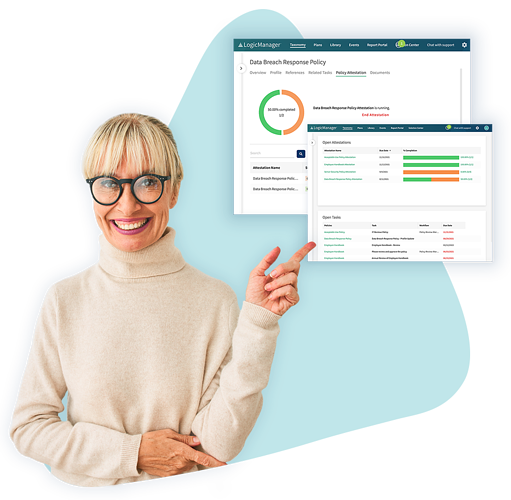

Customer ExperienceStreamline Your Risk Management Program

Unlike other software that requires IT professional customization, our solution allows customers to control engagement through an end-user configuration. This approach enables faster time-to-value and allows organizations to evolve their programs over time, not to mention a quicker return on investment.

Risk-Based ApproachPrepare for Tomorrow’s Surprises Today

A risk-based approach is the key to effective governance, risk, and compliance. By adopting this methodology, organizations can prioritize their efforts across different departments, recognize potential hurdles and crucial interdependencies, and allocate resources appropriately. Embracing a risk-based mindset allows organizations to strategically allocate their resources to areas that hold the most value in terms of privacy protection and compliance.

Complimentary Download Model Risk Management Datasheet

Learn more about how LogicManager empowers organizations to meet guidelines on Model Risk Management issued by the Federal Reserve and Office of the Comptroller of the Currency, which helps financial institutions and supervisors assess their organizations’ model risk management process.

CapabilitiesAn All-In-One Model Risk Management Platform

Frequently Asked QuestionsFoundations of Model Risk Management

Request a DemoLearn How LogicManager’s Model Risk Management Can Transform Your Enterprise Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.