What Is Risk Management? [Definition & Guide]

Last Updated: September 19, 2023

Curiously enough, uncertainty is the most certain part of life. The world will always be filled with uncertainty and with uncertainty inevitably comes risk. Risk management, in its simplest form, is assessing the possibility of something bad happening; i.e. “If I take this action, will it result negatively?”

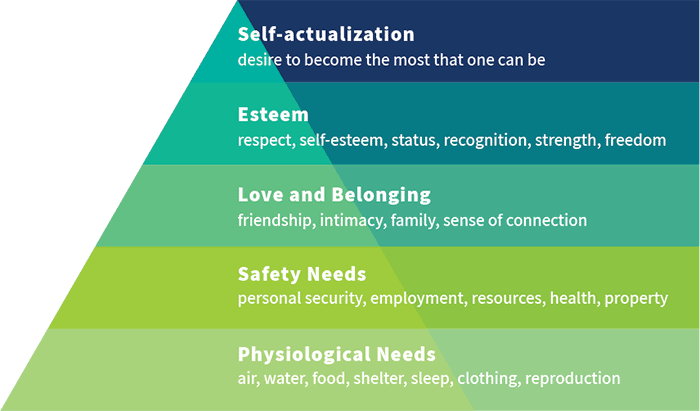

Negative outcomes are widely understood among humans because of our shared values. Maslow’s hierarchy of needs illustrates those values.

At the most basic level, Maslow’s hierarchy suggests that humans need to be secure physiologically. From there, we need safety. Higher level motivations are then driven by a need for belonging, self-esteem and self-actualization.

If at any point our needs are not being fulfilled, we view the situation as an undesirable consequence. It’s only inevitable that life becomes a series of avoiding these undesirable consequences. Here is an example of what that looks like:

There’s a chance it might rain today, so when you leave your house you bring an umbrella. On the most basic level, you did this to eliminate the risk of getting caught in the rain with no protection, resulting in soaking wet clothes that are physically uncomfortable. You also wanted to stay dry to keep your property safe; smartphones are still not 100% waterproof so you’re avoiding the risk of having to pay for a new phone. You also want to avoid the risk of being cut off from loved ones; ruining your phone ruins your sense of connection. Perhaps you’re heading to a client meeting. If you get absolutely drenched and need to find a change of clothes, you’ll be late and potentially lose the client’s respect. Losing their respect may cost you your job, which you may have worked towards achieving your entire life.

Whether you realize it consciously or not, bringing that umbrella just eliminated a risk that could have crumbled your entire hierarchy of needs.

Risk Management allows you to imagine tomorrow’s surprises today by managing risk.

While packing an umbrella is one of the most basic ways to stay prepared, risk is complex and life is unpredictable. The way humans manage risk is an undertone; we are always subconsciously thinking about the risk-reward tradeoff. Businesses, being powered by humans, naturally follow suit.

When we think about an organization, oftentimes risk-based decisions are made considering the consequences of inaction or taking a particular action. This is how people implicitly operate. However, implicit risk management is not enough to successfully operate a business.

Risk management should also involve a strategic and formalized process. With the right Enterprise Risk Management (ERM) software, your risk management efforts can help you imagine the unimaginable and prepare for what’s to come.

In this guide, we’ll answer what is risk management, detail the makings of a risk management plan, explain why risk management is important, and outline action items for enacting the risk management steps within your risk management plan.

Table of Contents

What Is Risk Management?

The risk management process involves identifying and assessing the likelihood of bad situations occurring. Once you have assessed these risks you will want to create a plan for risk mitigation and risk monitoring so that you are in control of potential threats.

Risk Management Definition

Risk Management Types

Now that you understand risk, understanding risk management seems fairly simple. It’s a concept that has been around for ages. However, risk management is an umbrella term that accounts for a number of more granular activities and encompasses the topic of GRC.

Let’s examine risk management as the sum of the following parts:

Enterprise Risk Management (ERM)

Effectively assessing risks, mitigating and monitoring activities as you uncover critical risks across your entire enterprise. Ultimately, it helps the company allocate resources effectively to protect its reputation, employees, investors and community.

Incident Management

Reporting, resolving, remediating and preventing incidents — from small hiccups to disasters — in order to protect your workplace by managing risk. An equally important aspect of incident management is giving employees a voice to speak up about any issue.

IT Governance & Security

Protecting your company’s assets, data and reputation by assessing risk and responding to incidents. This involves tracking your company’s technological resources, making sure their vulnerabilities are under control, and creating policies and procedures that are compliant with today’s evolving regulations.

Tracking regulations that you must adhere to, proving compliance, and staying on top of an ever-changing landscape. Doing so helps you maintain an exemplary reputation and empowers your company to operate under the highest standards of honesty and integrity.

Vendor Management

Ensuring that you’re working with top-notch vendors by managing who your third parties are, what services they provide, what sensitive information they have access to, which internal policies apply to them and so much more.

You can view our complete What is Vendor Management Guide here.

Financial Reporting

Tracking operational activities, attestations, and accountability to improve reporting efficiency and accuracy. This entails identifying risks of non-compliance, designing controls to address vulnerabilities, mapping controls to key objectives, testing controls for effectiveness, and reporting to regulators.

Audit Management

Making sure that every business area within your organization is stacking up and improving accordingly. This means monitoring controls to make sure they are as effective as possible. Internal process, compliance, IT, and facility-driven audits are essential to reduce threats and ineffectiveness and keep your business thriving.

Business Continuity & Disaster Recovery

Knowing which areas of your business are most critical, identifying resources for employees to keep crucial processes functioning and outlining recovery steps should havoc arise. Learn more in this business continuity guide.

Policy Management

Keeping track of the multitudes of policies your company has and creating the basis for which each one is implemented. This also means knowing every person associated with every policy and what their responsibilities are every time one of those processes kicks off.

Risk management should involve all of the areas discussed above. You can look at risk management as a way to proactively catalog organizational concerns and develop plans for how to address them. Once you’ve developed a thoughtful strategy, you enable better performance across your organization.

Why is Risk Management Important?

Realizing the importance of having a strong risk management function can save you money and drastically improve operational performance.

Asking, “What do we need in order to be prepared?” rather than planning a reaction pays dividends in the long run and is a key part of risk analysis.

Not only does having a strong risk management program save you money, but it also enhances performance. In fact, organizations that have a formalized enterprise risk management program tend to have higher evaluations thanks to their risk analysis. An independent research study, “The Valuation Implications for Enterprise Risk Management Maturity,” was published in the prestigious Journal of Risk and Insurance. This peer-reviewed and rigorous study conducted by Queens University MBA program definitively quantifies a 25% market valuation premium for organizations that have reached mature levels of ERM.

The connection between an organization’s risk management maturity level and market evaluation can be better understood by finding out your risk maturity score. The RMM Assessment allows you to score your ERM program on a five-level scale. Immediately after completing the assessment, you’ll receive an immediate benchmarking report that explains your current maturity level and offers actionable ideas for improvement.

For a complimentary copy of the RMM report “Why a Mature ERM Effort is Worth the Investment,” complete a free online RMM assessment here.

Risk Management Examples

Chipotle: Poor Risk Management

Since 2015, Chipotle has maintained notoriety for their repeated cases of food-borne illnesses. As they experienced one E-coli outbreak after another, the company disclosed to investors that its profits had plummeted by 95% in 2016 compared to the year prior. The stock price of company shares also plummeted by 45% the year following the outbreaks.

It turns out that the root cause of the outbreaks could be linked to the company’s decision to shift the process of prepping produce from central commissary kitchens to individual locations. While the initial decision to innovate could may have seemed smart at the time, Chipotle did not do their due diligence and monitor the vendor management risks, which led to significant losses.

Wimbledon: Good Risk Management

The most timely demonstration of risk management’s ROI is Wimbledon’s pandemic insurance plan. Over 17 years ago, following the SARS outbreak, Wimbledon purchased pandemic insurance at a rate of around $2 million per year. Fast forward to 2020 and the Wimbledon tennis tournament has been canceled as a result of the COVID-19 pandemic. Instead of suffering tremendous financial losses, Wimbledon is expected to receive an insurance payout of roughly $142 million.

It would be an understatement to say that Wimbledon was a step ahead of the rest of the world in terms of undertaking risk analysis. This was tremendous foresight that could have only been realized through detailed analysis and thoughtful planning; planning that did not happen implicitly.

What is a Risk Management Plan?

Having a clear, formalized risk management plan brings additional visibility into consideration. Standardizing risk management makes identifying systemic issues that affect your entire organization simple. The ideal risk management plan serves as a roadmap for improving performance by helping you understand key dependencies, risk analysis, and control effectiveness. With proper implementation of your plan, you ultimately should be able to better allocate time and resources towards what matters most.

Since every business has its own unique set of risks, it’s important to create a customized risk management plan for your organization. Profit motive, brand, size, industry, market share and many more characteristics all will prescribe your risk management program. That being said, all plans should be standardized, meaningful and actionable. The same framework for defining the steps within your risk management plan can be applied across the board.

Risk Management Steps

Step #1: Identify

Implementing risk identification techniques across your organization should be the first step to developing your risk management program. Note that it’s not enough to simply identify what happened; the most effective risk identification techniques focus on root cause. This allows you to identify systemic issues so that you can design controls that eliminate the cost and time of duplicate effort.

Step #2: Assess

Assessing risk in a uniform fashion is the hallmark of a healthy risk management system. Collect and analyze data so that you can determine the likelihood of any given risk and subsequently your remediation efforts with risk prioritization best practices.

It is also imperative to calculate your own risk appetite levels so that you can determine how much risk your organization is willing to accept.

Step #3: Mitigate

Risk mitigation is defined as the process of reducing risk exposure and minimizing the likelihood of an incident. Your top risks and concerns need to be continually addressed to ensure your business is fully protected.

Step #4: Monitor

Monitoring risk should be an ongoing and proactive process. It involves testing, metric collection, and incidents remediation to certify that your controls are effective. It also allows you to identify and address emerging trends to determine whether or not you’re making progress on your initiatives.

Step #5: Connect

Create relationships between risks, business units, mitigation activities, and more to create a cohesive picture of your organization. This allows you to recognize upstream and downstream dependencies, identify systemic risks and design centralized controls. When you eliminate silos, you eliminate the chances of missing critical pieces of information.

Step #6: Report

Presenting information about your risk management program in an engaging way demonstrates effectiveness and can rally the support of various stakeholders. Develop a risk metrics key risk indicators report that centralizes your information and gives a dynamic view of your company’s risk profile.

The ultimate goal of your risk management plan is to be as accessible and intuitive as possible. Even the most intentional and holistic plan will not be effective unless it is transparent and efficient. The best way to ensure a successful risk management program is by investing in smart software.

Frequently Asked Questions

What Is The First Step In The Risk Management Process?

The first step in the risk management process is to identify the risks that are likely to occur. The company will need to identify the risks related to their business by conducting a risk assessment based on surrounding areas that could potentially affect them.

What Are Different Ways To Manage Risk?

Risk avoidance and risk mitigation are the two main ways companies try to manage their risks. Risk avoidance is when a company tries to avoid taking on certain risks that could have negative effects. Risk mitigation is when a company tries to reduce the impact of risks that they are taking on. These actions will help companies manage their risk level.

What Are Some Benefits Of Risk Management?

Some benefits of risk management are saved time and money, better customer service, improved decision making by employees, increased productivity, decreased turnover rates among employees and increased profits for the company.

Why Is Risk Management Important?

Risk management is important as it helps reduce the impact of risks on business operations. If a company were to not take any risk management measures, this could lead to serious consequences where the company may incur great losses or even go bankrupt.

Conclusion

Your ERM platform should enable you to bridge the gap between organizational silos. It should take a risk-based approach and allow you to manage all of your information with a common framework. This is the most clear-cut path to driving results.

LogicManager’s ERM software is built on the very idea that silos hinder success. It empowers organizations to anticipate what’s ahead, uphold their reputation and improve business performance through strong governance.

Now more than ever, risk and understanding both ERM and ESG should be top-of-mind for every organization. Social platforms like Twitter, Facebook, Glassdoor and Yelp have empowered consumers to monumentally impact a company’s reputation. Corporate mishaps can now be instantly shared, magnified and multiplied. With this unprecedented control of the market, it’s no wonder there are multitudes of corporate scandals dominating news headlines.

Unlike the undesirable outcomes that we try so hard to steer clear of in our daily lives, undesirable outcomes in business are avoidable as long as you’re equipped with the right tools and services. Gone are the days of corporate risk management being recognized as merely a part of compliance. If you’re truly aiming to realize the full potential of your business, it’s critical to keep risk management top-of-mind.

Want to see exactly how you can benefit from our risk-based approach?