Financial Controls

Financial Compliance Software Solution

Inaccurate financial reporting that violates compliance requirements (such as SOX, MAR & ICFR) can result in reputational damage, revenue loss, and even fines. By managing your financial controls within a robust ERM platform, you can cut compliance costs while providing assurance to key stakeholders.

Protect your business and investors alike with LogicManager’s comprehensive Financial compliance software solutions.

This application can be achieved through:

You’re a protector.

Your organization relies on you to handle its financial resources – that’s a lot of pressure. It’s not only your job to make sure that you’re compliant with the Sarbanes Oxley Act (SOX), but you’re also in charge of Accounts Payable, as well as making sure you’re adhering to the Model Audit Rule (MAR).

But it’s a challenge to do it all on your own.

Tackling all of these areas at once can feel like a lot. Without robust software, carrying out your financial controls management duties can be time-consuming and unnecessarily difficult.

LogicManager is your solution.

Let us introduce you to a centralized software that erases all of your Financial Controls Management pain points in one fell swoop.

Accounts Payable

Here’s what you can expect with LogicManager’s Finance Accounts Payable solution:

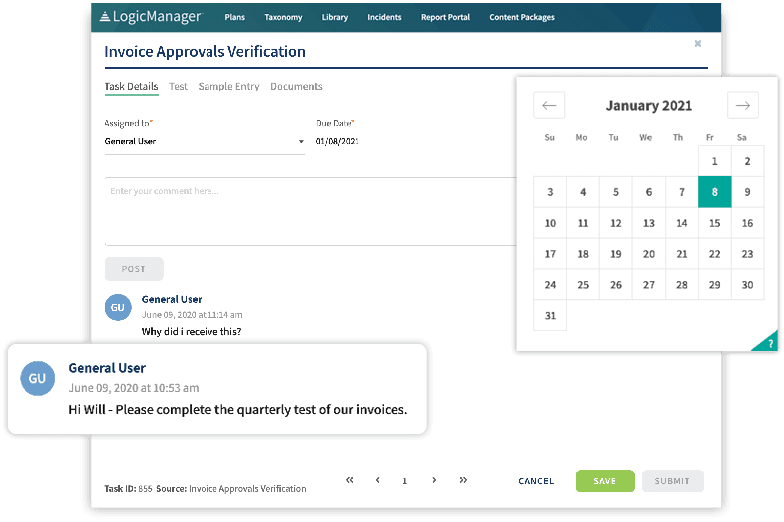

- Engage team members through date-based automated tasks to ensure consistency when documenting payment processes and keeping an accurate record of available cash flow.

- Through our task functionality, if a product or order is late, missing or inaccurate, you can easily engage with vendors to swiftly resolve the issue. Tracking this information over time gives you an accurate read on vendor performance year over year.

- Leverage forms to submit incidents for any problems that require unique attention. This may include order issues, payment discrepancies, or mismanagement of contractual agreements. By collecting data and automatically engaging the relevant parties through automated tasks, you’re tracking everything from start to finish.

- Through our reporting tools, aggregate all accounts payable information to easily see any outstanding payments, trending patterns or mismanaged vendors.

Model Audit Rule

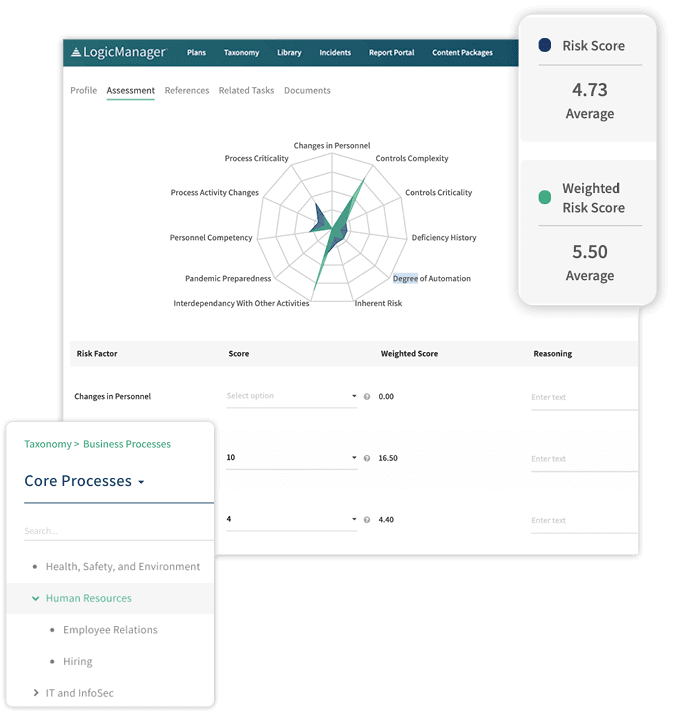

Achieve your MAR testing and reporting, as well as MAR risk control assessments, using LogicManager’s comprehensive solution:

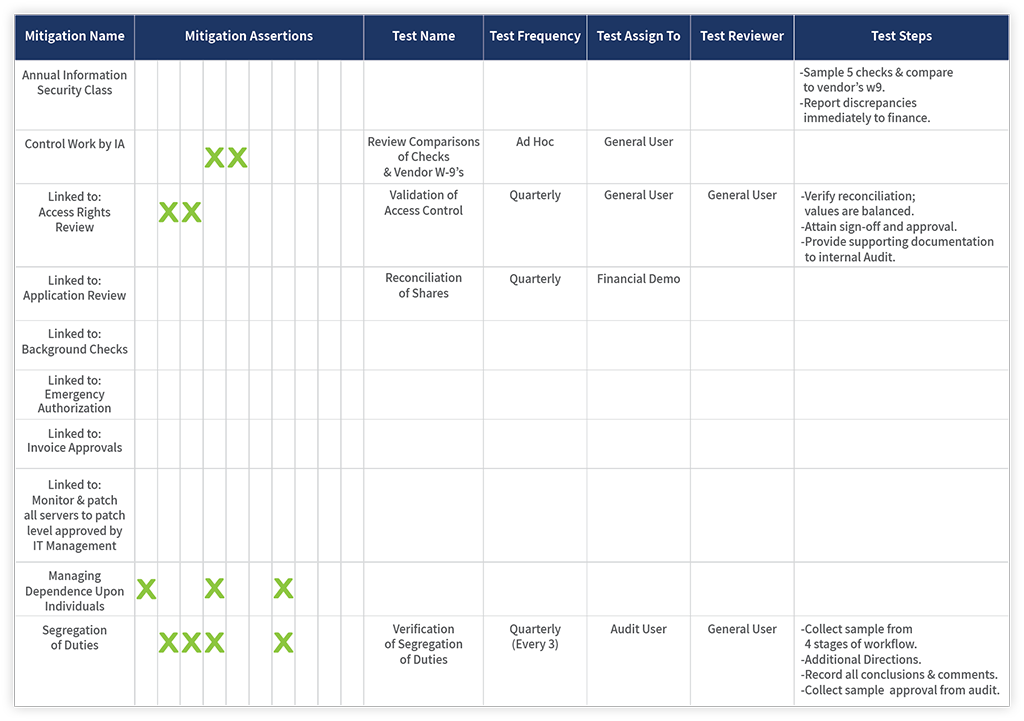

- Access a variety of financial risk assessments, compliance assessments, and control libraries housed within LogicManager’s centralized platform to review past work and provide observations and recommendations as needed.

- Tests can be linked to multiple controls across different business units, departments, assets, and more. By building these relationships, your organization can come to understand how a specific control impacts the organization as a whole.

- Working with your LogicManager Advisory Analyst, replicate any template you’ve previously been using in our report tool. This allows for minimal disruption in your existing processes.

- Our robust reporting engine helps facilitate your report creation. Here are some examples of commonly used reports for the Model Audit Rule:

- Mitigation Dashboard

- Testing Calendar

- Last Test Results

- Testing and Open Issues Dashboard

- Issues Summary

- Taxonomy Narrative (allows you to choose one audit and view everything recorded for the audit in the Taxonomy section of LogicManager).

Request a DemoLearn How LogicManager’s Financial Compliance Software Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.