Key Risk Indicators and Enterprise Risk Management

Last Updated: December 10, 2024

The world of business is full of risks, even for the most notable brands that have been practicing for decades. One of the best ways a brand can encourage longevity and success is through enterprise risk management.

Enterprise risk management explores your most vulnerable areas and suggests solutions to resolve them before they become costly and dangerous problems. Think about it — it’s much easier and more effective to mitigate risk before it causes issues than it is to deal with the fallout. Key risk indicators (KRIs) are some of the best tools in any enterprise risk management team’s arsenal.

What Are Key Risk Indicators?

Key risk indicators refer to the metrics used to analyze risk levels throughout various areas of your business’s operations. Monitoring these metrics provides insight into the health of specific areas of your organization. Common KRI examples include:

- Quantitative: Quantitative KRIs monitor data from algorithms and system outputs to single out outliers and determine areas for improvement.

- Qualitative: Qualitative KRIs analyze probability and suggest outcomes that may improve future odds.

- Financial: Financial KRIs focus on the money-related areas of your business, including acquisitions, budgetary measures, and economic changes.

- Operational: These KRIs evaluate risks that come with changes in workflow, such as updates to leadership and employment and process inefficiencies on the production line.

- Technological: Technological KRIs focus on security measures that protect your business and customers, potentially focusing on site logins, firewall access, security breaches, account management, and other digital projects.

- Human resources: Human resource KRIs involve internal negotiations and employee satisfaction by monitoring indicators like staff turnover and recruiting metrics.

Essentially, KRIs warn you of potential dangers before they come to fruition. Since the SEC ruling in February 2010, boards and CEOs (public and private) are depending more and more on operational risk management metrics. These include key risk indicators at the business process level, which have the proven capability to be escalated as necessary.

Internal audit is now required to validate the most timely and significant risks, especially those that impact the achievement of the organization’s strategic objectives and key performance indicators (KPIs).

Why Are Risk Metrics and Key Risk Indicators Important?

Risk metrics and key risk indicators are an important way to measure effectiveness. This is because risk managers must prove they are meeting the expectations of not only examiners and regulators, but also their customers and communities.

In the era of the see-through economy, the rapid advancement and proliferation of technologies like social media have left companies with one choice — transparency. This new visibility into businesses’ operations means public perception impacts companies’ reputations now more than ever.

If you implement a Risk Management program, measuring key risk indicators is the only way to accurately measure your effort’s value by identifying which previously identified risks you’ve successfully mitigated.

How to Develop Effective Key Risk Indicators

When you have the proper KRIs in place, your business can benefit from enterprise risk management as soon as you implement it. You’ll gain measurable, actionable ways to predict future and mitigate future risks before they can affect your business. While setting up KRIs does take some initial investment, many of them can perform on their own far into the future. Setting your brand up for success only takes a few steps.

1. Understand Your Key Objectives

KRIs can give you the information you need to thrive in all areas of your business. While you can implement dozens of types of KRIs, not all are useful to your specific needs. With that in mind, the first step to KRI development is identifying the objectives you want to focus on and exploring which KRIs will be most helpful in achieving those goals.

For example, you may decide that one of your key objectives is to manage your yearly budget better. In this case, you may want to focus on adding financial KRIs that monitor economic changes and in-house spending to your risk management action plan.

2. Identify Your Biggest Risks

Next, identify areas where your brand is at the highest risk and ensure you implement KPIs to help mitigate them, as well. Completing risk assessments and internal audits is beneficial during this step and may give you a better picture of risk areas you may not have already considered.

This step is similar to the first one, though it may uncover different concerns. Perhaps one of your main objectives is staying on track with your budget, but your largest risk area is in website security. Your key objectives and existing risk areas can and should inform one another, and both areas should be addressed through the KRIs you choose to focus on.

3. Select KRIs

With a solid idea of where to aim your KRI focus, you can start selecting specific KRIs in alignment with your goals. Consider these approaches:

- The top-down approach: KRI selection is closely influenced by upper management, who focus on business-wide goals. These KRIs get implemented across the entire brand, allowing every department to contribute to its standings. This approach is ideal for smaller businesses with significant crossover between departments or brands interested in KRIs that affect the entire staff, such as employee satisfaction.

- The bottom-up approach: KRI selection is done by department, allowing different sectors to choose the KRIs most relevant to their operations. The bottom-up approach is better for companies with clearly defined sections that can monitor themselves and focus on certain metrics in-depth.

4. Set KRI Thresholds

KRIs can start monitoring your information right away, but that information is useful only after you set thresholds that show where certain metrics are over- or underperforming. As your KRIs start collecting data, set upper and lower limits on the information — you can use data sheets to specify multiple values for various KRIs. When the data exceeds these parameters on either end, set up your KRI system to inform you immediately. Then, you can analyze the outliers and explore ways to change your workflow to keep values within the norm.

Average values for certain data may change with the seasons or even more frequently, so you may need to adjust your thresholds regularly to align with industry guidance and internal expectations.

5. Maintain Your KRIs

At this step, you’ve done the hard part of getting everything in place. Let your KRIs get to work and address situations as they arise.

Your KRIs will continue monitoring progress in the background as your team focuses on implementing its data suggestions and innovating new ways to evolve your brand. You should set up check-ins at regular intervals to examine your KRIs in full. Still, the proper automation tools will inform you of any significant changes or concerns that need immediate support.

Even with automation, appointing someone or a few people for continuity management is a good idea. Then, once a month or once a quarter, you can gather your top performers and examine all KRIs to see if there are ways you can adjust and improve your metric tracking.

Succeed With LogicManager Risk Tracking Solutions

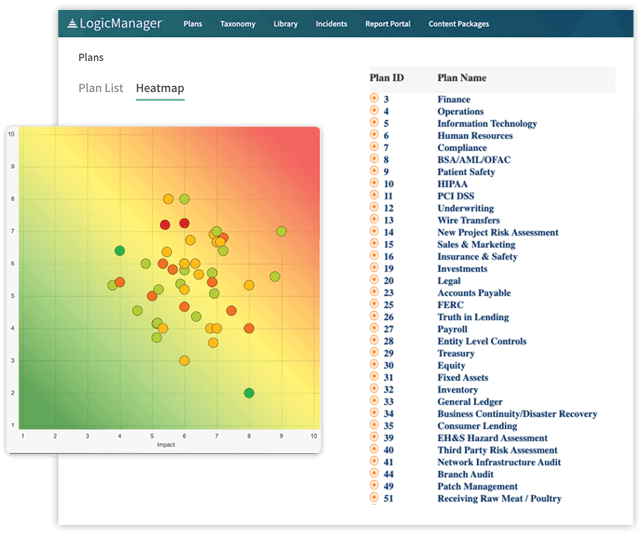

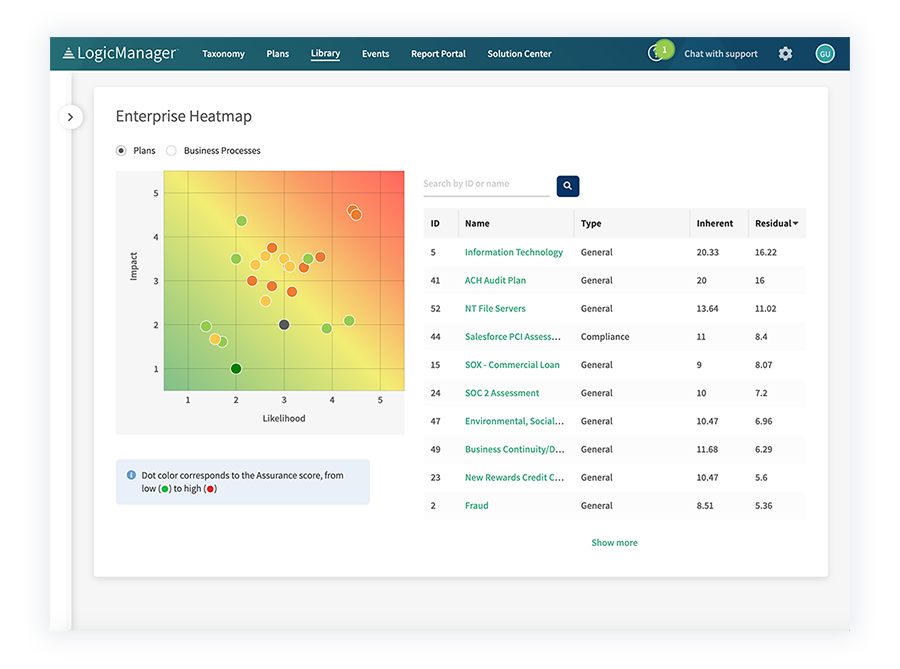

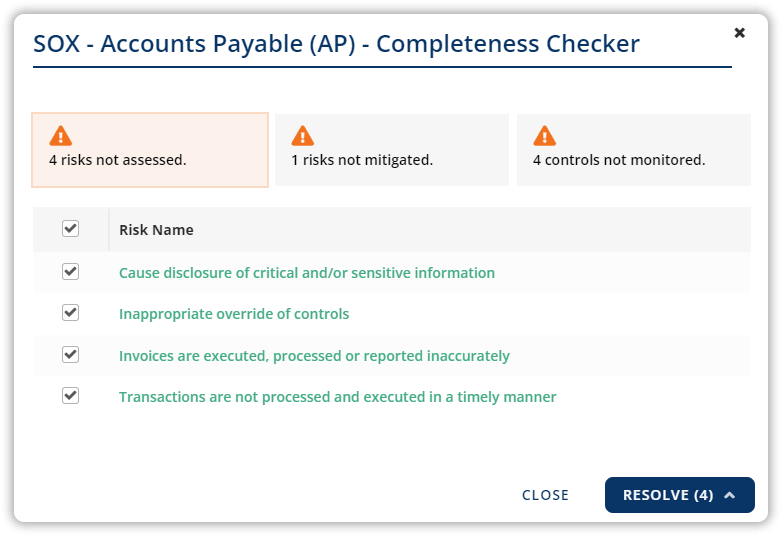

LogicManager’s Risk Reporting Software provides multiple reports to help risk managers identify gaps in assessments, mitigation and control activities, and monitoring and testing activities throughout the organization. Moreover, LogicManager enables all of these reports to be filtered by an assessment cut level, so organizations can focus on process improvement.

Our software doesn’t just help risk managers detect gaps across the enterprise — LogicManager provides resources and methodologies that help quantify and measure the value of the ERM program. Request a demo of this transformative software today.