SOX Materiality Risk-based Scoping Solution

Perform Materiality Assessment for SOX Compliance Testing

LogicManager's SOX Materiality Scoping Solution is designed to help you adopt an AS5 risk-based approach with materiality scoping for your SOX Program. Automate the mapping of assertions to your testing by linking your financial line item materiality scores to business processes and related risks and controls.

Key Capabilities to Drive Success:

- Risk Ripple: Automate the discovery of potential material weakness in your controls with LogicManager’s Completeness Checker which identifies significant gaps within your existing controls and control testing. Provide a targeted approach to increase assurance to support the board, risk committee, auditors, and regulators in meeting their fiduciary duties to govern fraud, waste, and negligence. Complete materiality scoring and automatically map to existing risk, control, and test processes to provide evidence of reasonable care.

- Prioritize Your SOX Audit: Provide your CFO, Board, and regulators more assurance while reducing your external audit fees at the same time. Use AS5 standards to provide evidence of materiality to reduce total external audit hours with a risk-based scoring of your assertions over financial line items linked to your risk, control, and testing efforts. Validate controls over risks to assertions and financial line items.

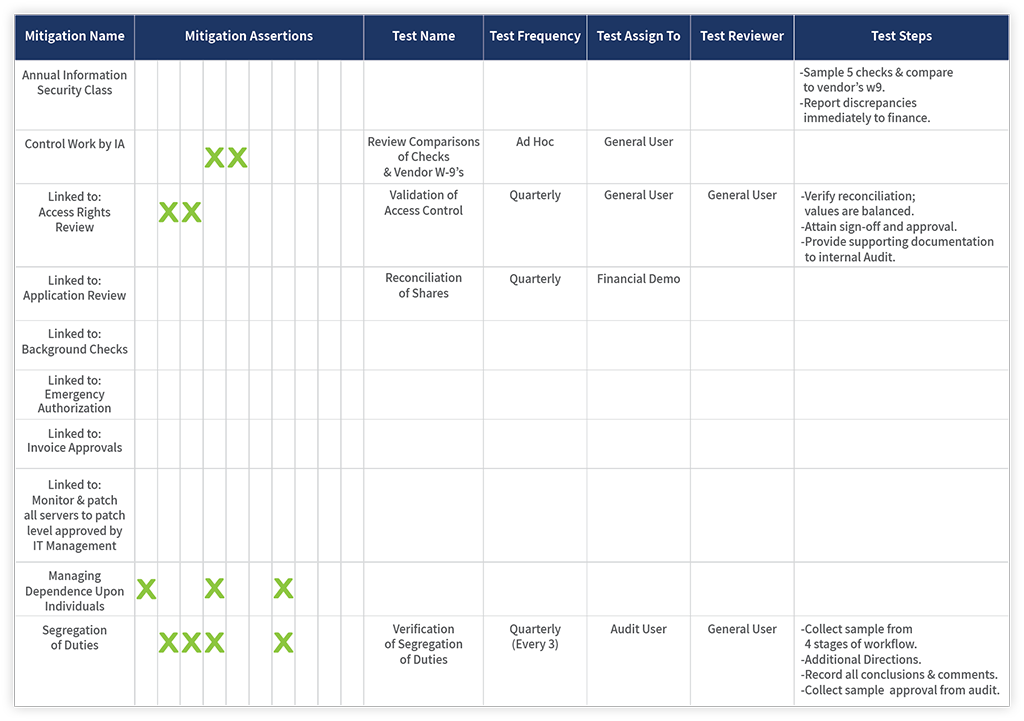

- Comprehensive Reporting Tools: Comprehensive Reporting Tools: Our standardized reporting packages provide workpaper reporting that tick and tie testing over each assertion covered by a key control as measured by a direct assessment of your financial line items. Provides a detailed overview of risk assessments, controls, and monitoring activities connected to your financial line item materiality scoping to provide evidence of compliance to meet auditor and regulator expectations.

LogicManager’s SOX/ICFR Risk and Materiality Assessment Solution

Here’s how you’ll be set up for success with LogicManager’s ICFR Risk and Materiality Assessment solution package:

- LogicManager’s centralized risk library provides out-of-the-box best practices to serve as a foundation for all your risk assessments. This library includes a comprehensive template for your financial risk and materiality assessment.

- Leverage any of our numerous frameworks and industry standards to guide the development of your controls and monitoring efforts.

- Beyond the content you’ll gain access to, as a LogicManager client, you’ll be assigned a dedicated pair of Advisory Analysts who will help migrate any existing data you have and can prescribe best practices as observed from other successful client implementations.

- Through our Financials Taxonomy, reference all standard financial assertions. Tag controls with corresponding assertions and associate them with relevant financial elements. You’ll also be able to document financial goals and plans and tie this information back to the risk and materiality assessment.

- Our reporting tools can be used for any aspect of your risk management program.

- A Work Book Plan Report offers a comprehensive picture of testing backed up by assessments, mitigations, and monitoring activities along with the relevant details organized into sections as your compliance team and auditors expect.

- The results of our automated completeness testing will enable you to provide evidence that relevant risks and assertions are validated and covered adequately.

- Provide evidence of effectiveness for anti-fraud and other policies, reliance on entity-level controls where appropriate and a stronger control environment

Areas for Efficiency & Cost Savings

While cost savings varies in form and degree, after the first year of using LogicManager’s SOX/ICFR Risk & Materiality Assessment solution, organizations increase their efficiencies by 10-40%. Here are 5 reasons why:

1: LogicManager users can directly link SOX controls to their IT systems and applications to streamline their testing processes.

2: Applying a top-down strategy to control testing eliminates duplicative work and ensures alignment.

3: Risk assessments of assertions related to material financial statement line items help to objectively prioritize higher risk control testing.

4: Our software is easy to use and train others on using, meaning our users increase collaboration from company personnel and third parties.

5: AI technology identifies opportunities for consideration of similar activity-level controls, which helps connect departmental efforts and reduce redundancy of review activity by SOX external audit teams.

What is a SOX/ICFR Risk and Materiality Assessment?

It’s critical to lay the foundation for an effective SOX testing program by using a top-down and risk-based approach. This means defining the scope of your SOX program to determine the materiality and risks that are managed by your key SOX controls. The Institute of Internal Auditors and the SEC strongly recommend doing so in their guidance.

A strong SOX/ICFR risk assessment will identify which controls are most important and why. This is extremely valuable evidence for an organization’s CFO and executive management when working with external auditors in negotiating whether new controls should be added, or if current controls should no longer be in scope.

There is often a gap between the Compliance team’s responsibility for SOX testing and the Finance team’s management of the risk and assertions over financial statement line items. It is essential to bridge the two teams in order to identify the key controls in place. Only then can you properly determine whether or not the risks to these assertions are being effectively managed.

Related Financial Content

Request a DemoLearn How LogicManager’s Risk and Materiality Assessment Software Can Transform Your Financial Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.