SOX vs. SOC: What Is The Difference? [Complete Guide]

Last Updated: September 19, 2023

Introduction

Many people confuse “SOX” and “SOC” – and rightfully so, as linguistically, they sound very similar. They also often fall within the same professional context when discussing compliance. But ultimately, SOX and SOC have very different meanings, purposes and contexts. We’ll dive into what SOX is, what SOC is, and how to apply SOX and SOC best practices at your organization in this guide.

SOC vs SOX

SOX is a government initiative which has been enacted in the financial sector with the aim of reducing financial fraud and increasing transparency. It is a set of federal laws that were enacted in response to a series of corporate scandals which shook investor confidence. On the other hand SOC focuses on internal controls to ensure consistent, accurate and complete financial reports. It is designed to increase auditability within the organization and help detect internal fraud or theft.

SOX Overview

“SOX” is a commonly used acronym that refers to the Sarbanes-Oxley Act of 2002. SOX was enacted to protect investors following multiple scandals involving public companies in the U.S. From inflated earnings reports, to embezzlement, illegal market manipulation and more, SOX was drafted to prevent future corruption. In the simplest form, the Sarbanes Oxley Act (SOX compliance) protects shareholders of publicly traded companies in the following ways:

- Closing loopholes

- Strengthening corporate governance

- Increasing accountability

- Requiring corporate transparency

- Protecting whistle-blowers

- Penalizing malfeasance

- Authorizing the Public Company Accounting Oversight Board (PCAOB) to monitor corporate behavior.

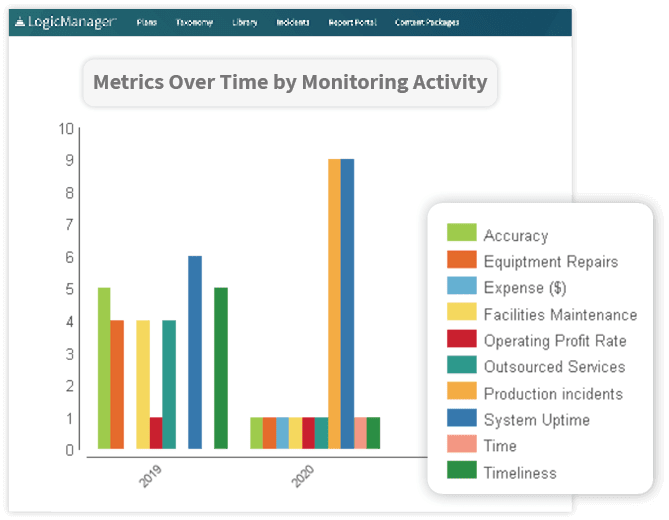

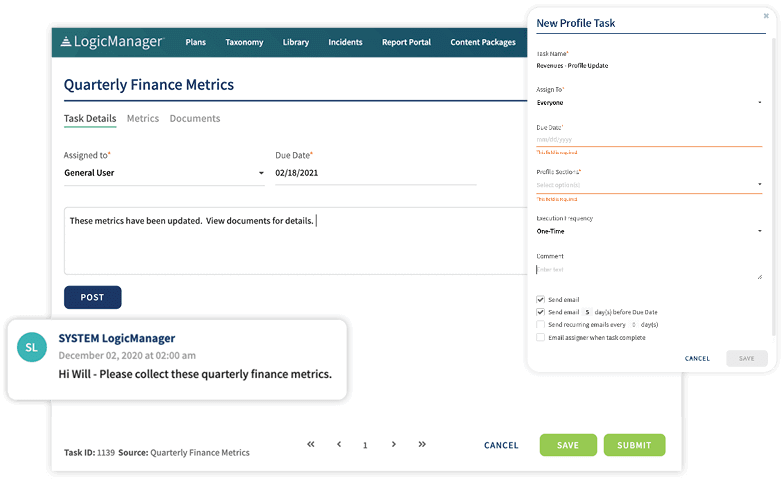

Because of SOX compliance, your organization is responsible for making sure your company is compliant with the act’s requirements. This means identifying risks, designing controls to address vulnerabilities, mapping controls to key objectives, testing controls for effectiveness and reporting to regulators. In terms of financial reports, it constitutes a very important component of the entire Governance, Risk, & Compliance landscape.

So what can happen if you’re subject to SOX regulations and you fail to comply? Chances are, you’ll suffer significant financial loss one way or another; whether you lose money in court, experience decreased brand approval or become a financial burden from behind bars. Furthermore, the fines imposed directly on corporate officers who disregard SOX are large; a corporate officer who does not comply with SOX or submits an inaccurate certification could be fined up to $1 million.

View our SOX Compliance Solution here

SOC Overview

“SOC” is the acronym for Systems and Organizations Controls. SOC reports were created by the AICPA amidst the rise of cloud computing, which has increased accessibility to applications and data. As a result of this increased accessibility, the risks and liabilities have increased as well. SOC reports aim to mitigate those risks to protect businesses and help them make more informed partnership decisions.

SOC 1 is based on guidance for auditors who are assessing financial controls at service organizations. SOC 2 and SOC 3 both examine a service organization’s controls that are relevant to the security, availability and processing integrity of their system, as well as their privacy and confidentiality.

SOC reports are becoming more and more relevant today as an internal control, especially in relation to data security. These reports empower organizations to identify cyberattacks and remediate them before irreparable damage has been done. Additionally, an organization can also utilize a SOC report to meet regulatory requirements that are critical to its operations.

View our SOC 2 Compliance solution here

SOX vs. SOC: Conclusion

Both SOX compliance and SOC compliance were created with the goal of protecting consumers and institutions from risk. That’s why here at LogicManager, we consider both to be integral parts of any mature ERM program. You can find out more about the various elements of SOX compliance and SOC 2 compliance in our what is SOX compliance guide and our what is SOC 2 compliance guide.

Request a demo of our ERM software today and see how these compliance frameworks can be woven into your organization today.