How to Connect the Dots Between Risks and Goals for Board Insight

Last Updated: June 4, 2024

Effective corporate governance hinges on the ability to provide the Board of Directors with clear, actionable insights into your organization’s risks and how they impact strategic goals. As a trusted advisor, you face the challenge of assembling information across functions and levels while maintaining a comprehensible picture of risk. How do you currently quantify your organization’s risks? Are you able to link operational risks to the strategic goals they impact? These are questions that risk managers often grapple with when trying to provide the Board with the information they need.

Risk Taxonomy is the Solution

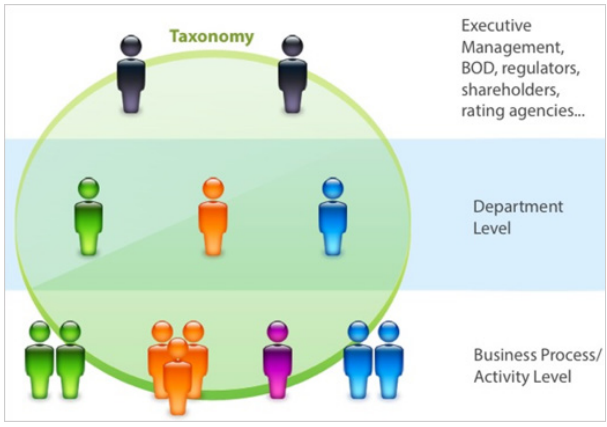

To overcome the challenge of providing a comprehensive view of the organization’s risks across all business areas, building a robust risk taxonomy is essential. Risk taxonomy involves naming, classifying, and defining relationships between resources, risks, goals, and business processes within the enterprise. Once the information is structured and relationships within your organization are explicit, assessments can be carried out on the same standards and assumptions. This standardization makes the information collected comparable, enabling cross-functional utilization for more accurate and actionable risk management.

Step 1: Take a Root-Cause Approach

Risk managers should provide a common root cause risk indicator library to process owners so that systemic risks and upstream and downstream dependencies can be easily identified and mitigated. When every process owner speaks the same risk language, their risk assessments become comparable across business areas. If multiple process owners select the same root cause risk indicator, it signals that the root cause is systemic or that there is a potential dependency to be uncovered. This method also highlights areas that would benefit from centralized controls, eliminating the extra work of maintaining activity-specific controls.

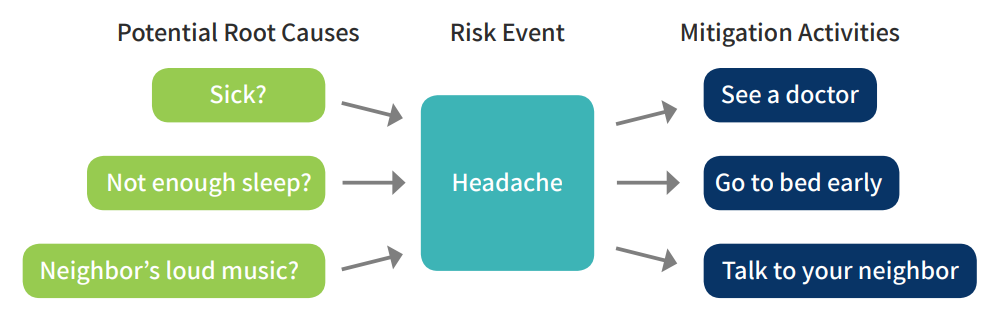

The most effective way to collect risk data is by identifying risk by its root cause. Root causes tell us why an event occurs, revealing where an organization is vulnerable. Only after identifying the root cause can you apply effective mitigation tactics. For example, to cure a headache, you need to know why you have one. If the root cause is lack of sleep, taking headache medicine won’t solve the problem. The Board and senior management want to avoid “headaches.” Your responsibility as a risk manager is to determine the potential root causes of these headaches so that appropriate mitigation activities can be employed.

Step 2: Standardize Assessment Scale and Criteria

The key to effective risk assessment is standardization. All assessments should use a common numerical scale and criteria. This approach ensures that assessments are objective, quantifiable, repeatable, and comparable. Standardized assessments enable better analysis, issue resolution, and issue escalation when necessary, facilitating cross-functional collaboration and decision-making.

Step 3: Align Risks, Activities, and Goals

The Board of Directors and senior management know the outcomes they want to achieve and avoid. As a risk manager, your job is to determine the root causes of these outcomes and how to best address them. Connecting root-cause risks to corporate goals is crucial. Start by identifying your organization’s strategic goals from strategic plans and other sources. Next, identify root cause risks that could derail these goals. Work with different business areas and process owners to understand which strategic goals their activities connect to. Align the identified risks with the activities connected to strategic objectives. This creates a linear alignment of risk, activity, and goal.

The Future of ERM Board Reporting

As we look to the future of ERM board reporting, three key insights emerge:

Risk Disclosures

Regulators will require that risk disclosures are not isolated legal and compliance processes but are connected to the activity level. Disclosures need to operationalize the risks, showing how they are managed through actual procedures and activities at the business process level.

Connection to Activities

You must show how risk disclosures are operationalized: identify the business area they stem from, who is accountable, and what mitigation activities are implemented. This demonstrates a clear connection between risks and the activities designed to control them.

Top-Down and Bottom-Up Approach

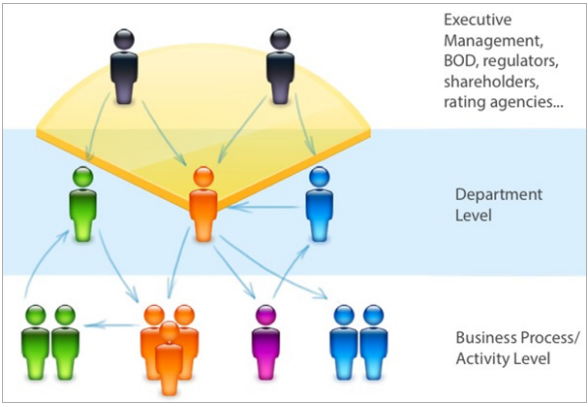

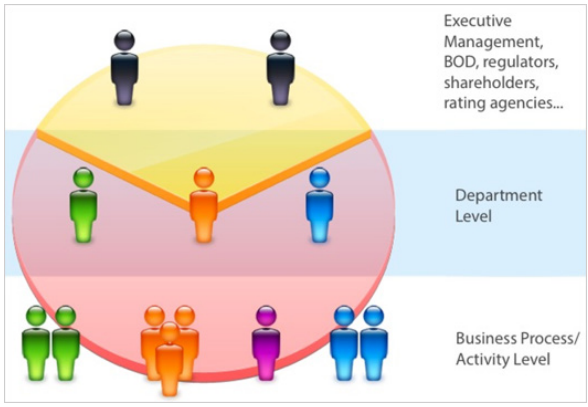

While strategic goals set by the Board and actions by senior executives are important, most risk events originate at the front lines. Collecting accurate information from process owners at the activity level ensures a comprehensive understanding of risks and enhances preparedness for mitigation.

LogicManager Can Help Your Business Present to the Board

Boards of Directors, through their risk oversight role, must ensure that the risk management policies and procedures designed by senior executives and risk managers are effective. Risk managers play a crucial role in closing the gap between strategic-level risks and operational risks at the front line. They set the standards, practices, and procedures for effective risk management, embedding them in all business processes.

An effective ERM software with a risk-based approach is essential for this process. LogicManager’s enterprise risk management software empowers organizations to uphold their reputation, anticipate future challenges, and improve business performance. Speak with one of our risk experts to learn more about how we can help you present clear, actionable insights to your Board.

In conclusion, by building a robust risk taxonomy, standardizing assessments, and aligning risks with activities and goals, you can provide your Board with the insights they need for effective governance. This approach not only enhances your role as a trusted advisor but also ensures your organization is well-prepared to navigate the complexities of risk management.