eBanking Risk Assessment

As a financial institution, your business needs to keep on top of risks coming from all conceivable angles. Stay ahead of online banking risks with LogicManager’s comprehensive eBanking Risk Assessment solution.

Take a root-cause approach

LogicManager’s global risk scoring criteria takes a root cause approach, fostering consistency on how you evaluate risks across your organization. This makes cross-departmental communication more effective and helps uncover systemic problems.

Identify areas for improvement

Based on the inherent and residual risk scores determined by your risk assessment, identify other areas that need to be improved. Do business continuity plans need to be updated? Are customer communication plans underdeveloped? How protected is your system? These insights help you continually improve your business.

Save time, money and resources

E-banking helps lower operating costs associated with in-person banking, but using an automated system like LogicManager to streamline your e-banking processes helps you reallocate resources more effectively, enabling you to save even more over time.

This application can be achieved through:

Why a Risk-Based Approach to eBanking is Important:

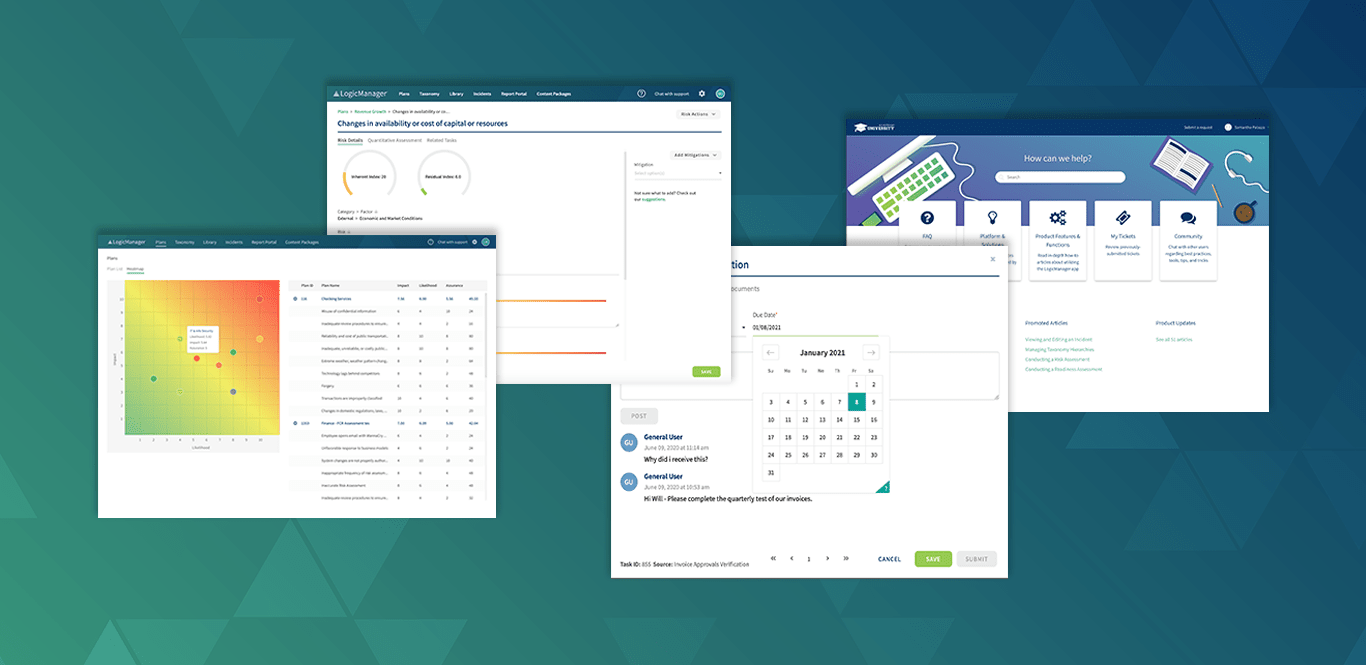

LogicManager’s eBanking Risk Assessment Solution

Here’s what you can expect with LogicManager’s eBanking Risk Assessment solution package:

-

Our risk library, a comprehensive catalog of risk inventory and categorization, is pre-loaded with common departmental concerns and templates relevant to eBanking to help you identify root cause sources of risks and better apply controls.

- Standardized risk assessments, like our eBanking risk assessment template, ensures risks are evaluated on an apples-to-apples basis across branches and departments. Use these as a baseline to get a sense for feasibility and risk appetite and ensure that you’re monitoring performance over time, copy them over from plan to plan to ensure consistency across assessments, while allowing for unique risks, controls or monitoring activities per department.

- Rather than duplicating controls as you would in a spreadsheet or non-integrated platform, entity-wide controls can be published to multiple branches or departments and across multiple modules of the system. LogicManager will also intelligently suggest controls based on your departmental risk assessments.

- Using our enterprise heatmap, identify systemic risks that materialize throughout the bank to better apply strategic controls, prioritize time and resources and make risk information more relevant to various stakeholders.

- Customize homescreens to appeal to the right user based on their role. Set up unique profiles that display everyday users’ most important action items or your executives’ favorite reports.

- Easily generate reports using our easy-to-use, drag-and-drop interface, or export data into any pre-built report from our comprehensive reports & dashboards catalog.

What is an eBanking Risk Assessment?

Online banking, or electronic banking, involves the use of computers (as opposed to human interaction) to conduct monetary transactions. Inevitably, there are risks associated with transferring money online and it’s important to know what those risks are ahead of time.

Online banking capabilities, while a huge innovation, has increased the exposure of banks and consumers alike. As consumer trends shift and technology advances, online banking is no longer just a perk offered by larger banks. Customers across the financial services industry now expect online and mobile banking. Private information that needed only be protected by bank branches is vulnerable because of this widespread remote accessibility. Financial institutions of all types and sizes need to perform regular e-banking risk assessments.

A risk assessment, a process that analyzes the specifics of various risks, is a fundamental process within any ERM program. An ebanking risk assessment is a risk assessment that analyzes the risks involved with conducting banking online.

Online Banking Risks

There are a variety of risk exposures introduced to your organization when you implement e-banking. For example:

- Consumers have come to expect 24/7 support when it comes to online services. Should you experience a service interruption, customers may not be able to complete critical transactions and ultimately become less satisfied with your company.

- If a breach occurs and your customers’ sensitive information is compromised, the damage can be irreversible. If your organization is found at fault, fines can quickly add up.

- Outages or disruptions can cause customers to miss payments, which can prevent them from continuing a service or finalizing a time sensitive purchase. It can even lower their credit score.

Request a DemoLearn How LogicManager’s eBanking Risk Assessment Software Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.