Insider Trading Attestation Software

Penalties for Insider Trading range from a few to 25 million dollars. On top of that, the negative reputational impact often leads to shareholder anger, customer abandonment and plummeting stock prices. Mitigate these risks through our robust Insider Trading Attestations solution.

This application can be achieved through:

Why Taking a Risk-Based Approach to Insider Trading Attestations is Important:

LogicManager’s Insider Trading Attestations Solution

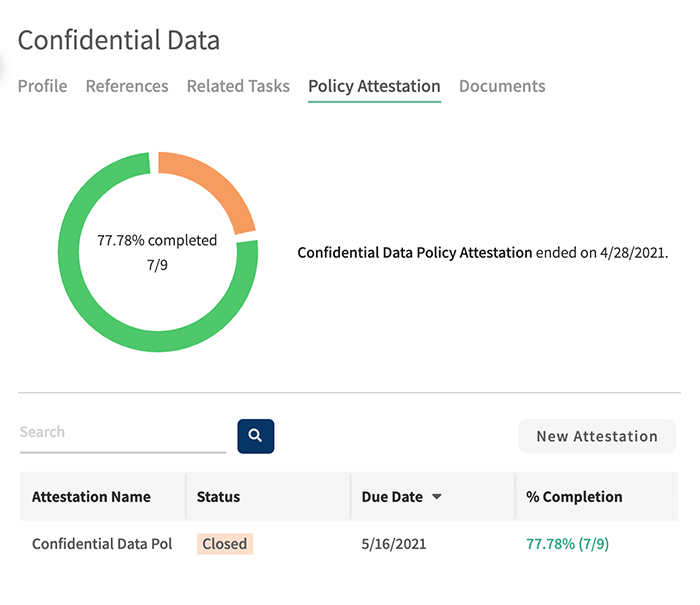

- Use LogicManager’s incident functionality to collect insider trading attestations from each of your employees, including the results from customizable quizzes and surveys.

- Cut manual data transfers out of your process and use LogicManager as your centralized repository for all your GRC information. Leverage existing work within LogicManager to optimize your process, and also use LogicManager’s review workflow to review each attestation submitted and link to the appropriate employees.

- Run reports that highlight who has and has not submitted attestations, ensuring there are no gaps in your insider trading education and coverage.

- Proactively manage the risks associated with insider trading by giving employees a form to pre-clear trades they want to make. Use this same workflow functionality to automatically route that proposed trade to Legal or Compliance for their sign-off or rejection.

- Passing brokerage statements from one party to another via fax or email often leads to inappropriate access and potential fraud. LogicManager’s secure incident forms and document attachment fields can be trusted to keep sensitive information safe and secure as employees participate in your Insider Trading Attestation process.

Benefits of LogicManager’s Insider Trading Attestations Solution

Maintain a Centralized Repository

Because LogicManager is a GRC platform, you’ll be able to link your insider trading attestations back to the employees in your people library, the policies in your policy library, or back to your core processes, all without ever leaving the attestation you are reviewing.

Identify Areas of Weakness

Determine where you are most susceptible to insider trading and build and implement the necessary controls to mitigate those threats. For example, the time before earnings reports come out is a sensitive period during which you may want to restrict employee trading on company-owned securities.

Streamline your Program

One strategy to prevent insider trading at your organization is appointing an in-house watchdog to collect and review some employee’s brokerage statements. Typically, this is a highly decentralized and time-consuming job. With LogicManager, ease the burden on your watchdog by centralizing the collection of information and managing each step through a workflow. Using LogicManager, easily pass employees educational material and have them take a quiz to make sure the most important information sticks.

What is Insider Trading?

According to the SEC, insider trading refers to buying or selling a security in breach of a fiduciary duty or other relationship of trust and confidence specifically “while in possession of material, nonpublic information about the security.” It is also considered insider trading to tip off information to those who then misappropriate such information.

Insider Trading Risks

From a hard dollar perspective, the monetary losses you can experience as a result of being caught violating Insider Trading laws are severe. The SEC does not just target rogue agents who have concealed their trading from the larger organization; the organization can also be targeted for civil lawsuits and fines, especially if the firm was seen as negligent. Penalties can easily range from a few million to up to 25 million dollars.

Considering potential soft dollar losses, negative reputational impact if news comes out that your employees have been engaged in insider trading is a serious concern. If could be even worse if the investigation implies that your company was negligent in educating employees on these types of illegal activities. Ultimately, public scandals lead to shareholder anger, plummeting stock prices, removal of leadership and employee and customer distrust and abandonment.

Request a DemoLearn How LogicManager’s Insider Trading Attestation Software Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.