Coronavirus Business Risks:

5 Risks to Assess

Steven Minsky | March 3, 2020

We discussed the importance of leveraging ERM to prepare your organization for the impact of coronavirus in my last blog here. As discussed risk management is essential for the Coronavirus and by implementing good risk management for Covid-19 your company will be able to reduce the Coronavirus business risks.

Now that you are aware of the importance of ERM, we will discuss imperative considerations that all organizations should explore to gain a deeper understanding of the business risks that Coronavirus could have on their company.

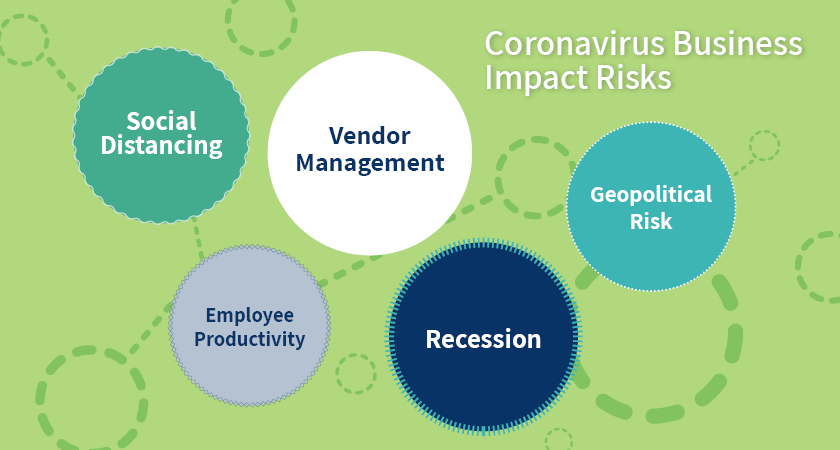

5 Coronavirus Business Risks

Below are some of the key risks that organizations face as the Covid-19 crisis deepens. Being aware of these risks is essential when it comes to business preparation for Covid-19.

Risk #1: Social Distancing Disruption?

Social distancing is a term applied to certain actions that are taken by public health officials to stop or slow down the spread of a highly contagious disease. During the peak contagion months from December 2020 thru March 2021 policies of “social distancing” are likely to be necessary in the United States workforces and schools. Most business events and travel will be curtailed or canceled during this peak period of approximately four months. How will your organization generate revenue and execute operations with your workplaces mostly off line and remote? Only 14.1% of all retail sales worldwide were estimated to have been done through the Internet in 2019. With physical purchasing cycles potentially being disrupted, what will happen to that remaining 85.9 percent of business activity?

Risk #2: Employee Productivity Drops?

Every industry will be impacted from the November to February timeframe as organizations are likely to see up to 40% of staff during this period be unable to work due to sickness, either directly or indirectly, from the coronavirus. Even if your staff is not sick, many will be impacted by needing to care for sick children and relatives as well as impacted by school and daycare closings.

Risk 3#: Vendor Management – Shortages?

The global economy is still highly integrated and most countries and companies rely on vendors for their business. From pharmaceutical raw materials to electronics to most consumer good products there will likely be purchasing delays. Heavy equipment and manufacturing supply chains are already being impacted by Covid-19 spreading across Asia and Europe. Let’s also not forget there is a major trade war with many trading partners that remains unresolved.

Risk #4: Recession – Unemployment – Investment pull-back?

Forecasts are indicating that we will likely be in a full recession by Q4 of this year. Will consumers reduce their spending? Conferences are getting canceled. Corporations are asking people to work from home. Schools are getting closed. Watch the hospitality industry for signs of economic health. The economic engine of growth is driven by continuous investment as well as consumption. Experts have uncertainty for a Covid-19 vaccine being available before Q1 2021. Investments are highly negatively impacted by uncertainty and corporations will likely be cutting back growth investments. We may see a rise in unemployment from those four million students hoping to enter the workforce after graduation in May 2020. There may be significant layoffs of personnel at existing businesses in the “second wave” of Covid-19 that may resurge in Q3 2020.

Better Risk Assessments

Check out our eBook with 5 steps for better risk assessments here!

Risk #5: Geopolitical Risk – Economic Instability – Civil Unrest?

The United States is going through a major election cycle in November, at the same time the second wave of Covid-19 may be hitting. This election more, so than any other in recent history, represents two very different sets of policy options that will dramatically alter how businesses operate from taxation to foreign trade to talent management. This is not a political statement. Either scenario is manageable. It is the uncertainty of which scenario will prevail and how those policies will be carried out is what will be driving the risk. The US budget deficit is at a record high and government spending will ramp-up, but may not be effective due to lack of planning and preparedness. Great Britain has left the European Union and is an interim period through December 2020, upon which dramatic changes are likely to go into effect for trade, immigration, and a large range of other areas of international business, also as the second wave of Covid-19 may be hitting.

Next Steps: Coronavirus Risk Assessments

So now what? Firstly, organizations need to put in place actionable mitigation plans to address each of these risks and put a business continuity plan for Coronavirus in place. By putting in these measures you will be in a better position to reduce the risks that the Coronavirus will have on your business.