What Should be Included in a Third-Party Contract?

Last Updated: June 4, 2024

Your third parties help keep your business running smoothly. Similarly, the contract between your business and a third party, or a third-party contract, keeps the relationship between your two organizations running smoothly.

This guide will dive into the key components of what should be included in a third-party contract, including everything you need to know about third-party contracts, including why it’s important to have one, the key components of any third-party agreement, third-party contract types, an example of a third-party contract, and a handful of third-party contract FAQs.

What is a Third-Party Contract?

A third-party contract, sometimes referred to as a third-party agreement, is a document that establishes a business relationship between two parties.

It makes it clear that there will be an exchange of goods or services for compensation and details each party’s obligations throughout the duration of the business relationship.

Why Use a Third-Party Contract?

A third-party contract is an important document that protects your business relationship, prevents unnecessary liability or negligence, and ultimately keeps your business protected should the other party file a lawsuit.

In the shorter term, a third-party contract exists to set and maintain expectations for both parties so that they can each prioritize their time and resources and proactively manage risk and has many benefits.

Key Components of a Third-Party Agreement

There are numerous clauses you may find in a third-party agreement that are considered when negotiating third-party contracts. Below we explain a few of the most common components that will be found in most types of third-party agreements:

Relationship of the parties

It should be made very clear within a third-party agreement that the third party is to be considered an independent contractor and that they are in no way able to act on behalf of the other party.

Scope of services

A third-party agreement will typically contain a clear and detailed description of the product or professional services the third party will be providing.

Limitation of liability

This type of clause is very commonly included in a third-party contract. A limitation of liability clause excludes certain types of damages from a party’s liability and typically provides a monetary cap to a party’s liability.

Payment terms

The contract between a third-party and your organization will also typically include information about how much the product or service will cost, who payments should be made out to, when they are due, etc. It will also likely disclose their late fee policy.

Confidentiality

A third-party contract should cover how the disclosure of confidential information will be handled: What is the definition of “confidential?” How long is the period of protection?

Termination terms

A third-party agreement should define the term of the relationship and explicate how either party should go about terminating the agreement if necessary.

Intellectual property

In the instance of either party in the agreement providing intellectual property (IP), the business contract must clearly state who owns it, what it can/can’t be used for, licensing requirements, etc.

Deliverables

A third-party agreement should also provide information about any potential deliverables, including their due dates, the business owner and more.

Third-Party Contract Types

There are a variety of third-party contract types. Which type you use depends on the nature of the third-party relationship that you’re entering into.

Below are 3 common examples of types of third-party contracts:

Time and Materials Contract

In this type of third-party contract, the customer and third party agree to an hourly rate and define a time frame the project will be completed within. This is typically used with consultants, freelancers, and other external contractors.

Distribution Agreement Contract

This is a written agreement with a distributor and third party. It outlines the when/where/how of product distribution, and gives distributors the right to sell and profit from a third party’s products.

Fixed Price Contract

In this type of third-party agreement, the buyer and seller agree to a fixed price for a “well-defined product,” regardless of factors that might impact the cost or value of the product.

Related Post: What Is Third-Party Management?

Third-Party Contract Example

Let’s imagine you’re hosting your annual company conference. In order to facilitate networking and allow your guests to be comfortable while doing so, you’ll need to provide tables and chairs on the days of the event. But your company doesn’t produce its own line of tables and chairs, so you need to outsource that product in exchange for currency.

You’ll need to draft up a third-party agreement between your company and the company that will be providing the tables and chairs. It would likely include:

- The color, style, and sizes of the tables and chairs you would like at the event

- The date the furniture will need to be delivered on

- Who will be retrieving the furniture and where, on which date and at what time

While the above terms would apply to the table and chair third party, your organization would agree to terms like:

- What price you will pay for the furniture

- The quality in which the tables and chairs must be returned (and what would happen should they not return in the expected quality)

- When the tables and chairs will be picked up by after the event has ended (and what would happen should they not be returned)

Third-Party Contract FAQs

There are a lot of commonly asked questions surrounding third-party contracts. Below we’ll answer a few of the most popular ones and provide answers that hopefully point you in the right direction:

How do you draft a third-party contract?

Usually with the help of your legal team, drafting a third-party contract involves the following steps:

- Specify the terms of the business relationship. Who is the customer and who is the third party? Who is obligated to do what? What is the price the third party is requiring and what are the payment terms?

- Outline the legal concepts. This section includes promises about the quality of the products and/or services, the party’s rights to sign the contract, and details any compliance with applicable laws.

- Address any consequences. What happens if things go wrong?

How do you keep track of contracts?

It can be a lot of work to manually keep up with your third-party contracts. Here are a few recommendations for keeping track of it all:

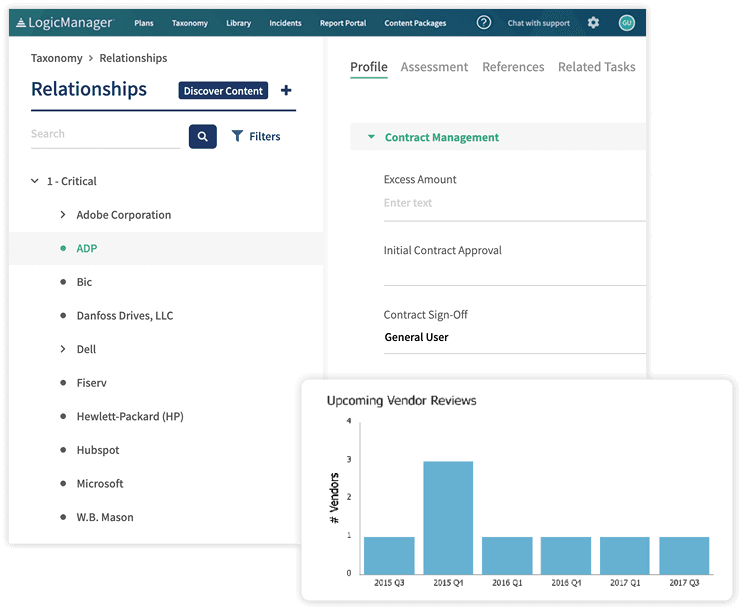

Automate your processes: Ensure that there are automated processes in place, such as task notifications or workflows, that ensure you never miss a key date. These automations, typically implemented through VMS software, also help to engage all relevant stakeholders and prevent human error.

Track critical information: It’s important to continually monitor third-party service-level agreement performance to ensure your contracts are in line with your standards and your partner is holding up their end of the bargain. While tracking, be sure to generate reports and dashboards that provide visual insights into your contracts based on key criteria like renewal/expiration date, contract value, third-party type, and more.

Centralize your processes: It’s important that Accounts Payable knows who to pay and when, so make sure your systems are talking to each other. Centralize your processes and lines of communication using integrated software. Procurement risk compliance software can assist by integrating directly with your ERP platform.

What should be avoided in a third-party contract?

It’s equally as important to know what to avoid in a third-party contract as it is to know what should be included in one. Here are a few examples of things to make sure your third-party agreement does not have:

- A poorly defined exit strategy. If your organization is looking to end a third-party partnership, you’ll look to the third-party agreement for the exit strategy. If the exit strategy is vague or has conditions that favor the other party, you’ll be left confused and wasting time trying to determine the next best move.

- Generalities. When developing your own third-party contract or reviewing one from a third party, avoid using or agreeing to general terms like “reasonable” security measures. This leaves room for interpretation, as “reasonable” means something different to everyone.

- Any potential for data mishandling. Keep an eye out for contract terms that rid the third party of any responsibility to protect your customers’ data after your agreement has ended.

In Summary: What Should Be Included In A Third-Party Contract?

You can outsource a service, but you can never outsource a risk. That’s why it’s best practice to mitigate third-party risks ahead of time through an integrated, risk-based approach.

Taking a risk-based approach to your third-party contract review and management program enables you to identify risks before they materialize into problems for your organization, assess threat levels and risk criticality, write more effective contract terms, monitor service-level agreements (SLAs) over time and ultimately make more informed decisions when determining whether or not to agree to or renew third-party contract.