Spend Risk Management

Eliminate Liabilities and Reduce Unnecessary Spend

LogicManager's Spend Risk Management solution empowers you to cut liabilities and trim excess spending by pinpointing fraud, waste, and negligence risks in your expenditure data. Gain clarity on third-party expenses, evaluate critical partnerships with objective risk assessments, and seamlessly integrate various ERP systems.

Our Spend Risk Management solution allows you to:

- Identify how much you are spending on third parties

- Identify critical third parties– and their associated risks using intuitive, objective risk assessments.

- Easily integrate disparate ERP systems, including Workday and Deltek Costpoint.

For additional value:

Why Logicmanager? – Users of LogicManager’s ERM software explain how their risk management programs have benefited from our platform and expert advisory service.

Customer Success StoriesExplore How Companies Overcame Challenges With Our Spend Risk Management Solution

How To Take a Risk-Based Approach to Third-Party Risk & Contract Management

In this presentation, Bryan Phillips from Federal Home Loan Bank of Indianapolis discusses the third-party life cycle and how he built his TPRM program with LogicManager.

Risk-Based Third-Party Management in the Financial Industry

How one bank used LogicManager to overcome third-party risk management challenges and achieve success

What Our Customers Are Saying...

The LogicManager DifferenceA Holistic Approach to Spend Risk Management

Business Decision InsightsFocus on What’s Important

Through our ERM software, we allow our customers to spend more time strategically managing risks– and less time on tedious administrative activities, like data cleansing and manipulation. Eliminate repetitive reconciliation between systems.

Customer ExperienceStreamline Your Risk Management Program

Unlike other software that requires IT professional customization, our solution allows customers to control engagement through an end-user configuration. Link risks and controls to the business areas and resources they impact with our taxonomy technology. This approach enables faster time-to-value and allows organizations to evolve their programs over time, not to mention a quicker return on investment.

Risk-Based ApproachPrepare for Tomorrow’s Surprises Today

We believe success is a result of effective risk management. Taking a risk-based approach to your risk program allows your organization to prioritize time and resources appropriately, determine functional areas that pose the greatest threats, and identify the most critical controls.

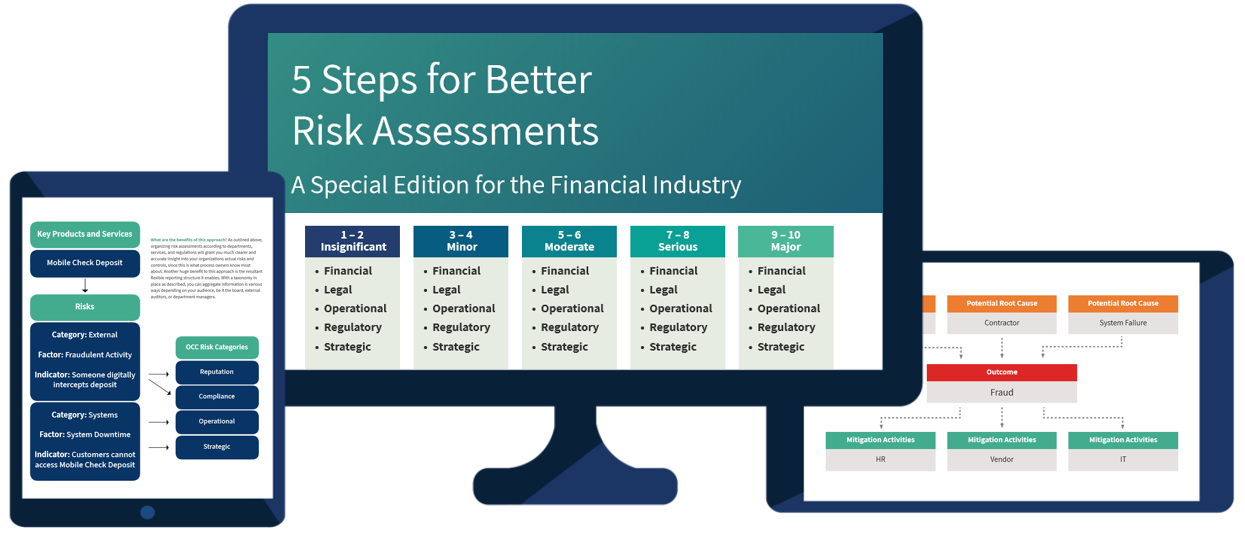

Free eBook5 Steps for Better Risk Assessments: Financial Edition

Learn how to make your assessments comparable across departments and levels, aggregate the information in a way that adds value to your financial organization, organize your risk assessments to comply with the big regulators like the OCC and FFIEC in this free eBook.

CapabilitiesAn All-In-One Third-Party Spend Compliance Platform

Frequently Asked QuestionsFoundations of Third-Party Spend Compliance

Request a DemoLearn How LogicManager’s Spend Risk Management Software Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.