Let’s break down the ROI of ERM into two separate categories: hard dollar and soft dollar savings.

Hard Dollar Savings = Actual money saved, or the reduction or avoidance of an existing cost.

Soft Dollar Savings = Not a direct cost savings guaranteed, generally tied to efficiencies.

So where exactly are those savings realized? It differs based on the associated risks of each governance area of your organization:

| Area of Governance | Hard Dollar | Soft Dollar |

|---|---|---|

| Regulation & Compliance | The price tag for fines and legal expenses resulting from noncompliance range from thousands to multiple millions of dollars. | Public scandals often lead to shareholder anger and plummeting stock prices, removal of leadership, and employee and customer distrust and abandonment. |

| IT Governance / Security Incidence | Negligence is 100% avoidable. Once you are found guilty of it, the fees associated with hiring lawyers, consultants and internal specialists skyrocket quickly. | In addition to incident and negligent legal liabilities, the loss from customer non-renewals and cancellations is significant. It’s estimated that the total average cost of a data breach is $3.8 million. |

| Vendor Risk | Consultants and additional FTEs are required to run a due diligence & contract program in absence of software. Once you factor in the cost of unintended auto-renewals and duplicative contracts, expenses become high. | Customers don’t care if your vendor is ultimately to blame for an issue; the reputational damage is ultimately a forfeiture felt directly by your company. |

| Enterprise Risk Management | Risks are everywhere, and lacking ERM software can lead to a rating downgrade (lending cost) or warning flag (staff costs) as well as business continuity failures and product liability issues. | Without a robust ERM program, you have no evidence to prove that you were not negligent. Regulatory penalties & fines, along with lost jobs and shareholder value decline can add up. Take the example of Citigroup, who was recently fined $400 million for risk management deficiencies. |

| Business Continuity | Without software, testing and maintaining a comprehensive BCP requires dozens of staff and consultants. Furthermore, enormous financial impacts will be felt following calamity without a strong BCP in place. | Labor and supply chain disruptions result in lost revenue and erosion of investor confidence, which will cause stock prices to plummet. |

| Internal Audit | Failure in the last line of defense puts everything in your entire business at risk. Often these functions increase your exposure, are under-resourced, or require many FTEs to manage. | It is your fiduciary responsibility to report all risks to the board; if you are unable to provide evidence that you are remediating risks, you can be found guilty of negligence, exposing you to fines and penalties. |

| Human Resources | Employees are both your number one asset and number one liability. The criticisms are wide-ranging, from an incident or scandal, to how you handle a new working environment and keep your employees safe during a pandemic – no matter the implications, it’s a lawsuit waiting to happen. | Employee distrust can quickly create a toxic environment, which can lead to employee churn and unproductivity. You’re especially at risk of these losses amidst today’s polarizing times and the See-Through-Economy, where you will be judged harshly by employees and customers alike based on how you plan and react to crises. |

ERM Software

Pays Off…

Gain up to 80% in efficiency in time and effort and reduce total internal and external audit consultancy by more than 15%.

Strategic technology investments, such as an ERM platform, can reduce annual extended enterprise management operating costs.

Studies find mature levels of ERM = Increased Market Valuations

Identifying tasks that can be automated in an office environment is key to ensuring productivity if people do fall ill.

Cost and revenue recovery programs that are aligned with extended enterprise risk management can lead to 25-50% reduction in annual third-party management operating costs.

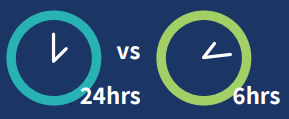

During a 40-hour work week, risk managers spend over 24 hours on tactical tasks rather than strategic planning. Our customer base indicates that ERM cuts this time to about 6 hours per week.

Deloitte’s research found that cost reduction is the reason cited most often for investing in extended enterprise management, with 62% of respondents citing it as such in 2019, up from 48% in 2018.

Did You Know…

LogicManager’s software environment allows for rapid remediation. Companies can be up and running in as little as two weeks.

You can easily automate the distribution of critical info through LogicManager’s encrypted, compliance ensuring incident management functionality.

Best practices are built into all of LogicManager’s templates, enabling you to start your BCP plan off on the right foot and avoid negligence.

Next Steps

LogicManager’s roots are in helping customers prepare for and thrive during difficult times. We have successfully guided customers through the 2007 recession, the associated TARP bail-outs as well as the H1N1 pandemic of 2009. Most recently, we’ve been there throughout the COVID-19 pandemic. As we wrote about in our blog, our company was built on a foundation of seeing around the corner, and our software is designed to help you predict and prepare in order to do just that.

The pandemic has disrupted operating models of businesses across the globe. Since the beginning, LogicManager has partnered with our clients to help them pivot wherever needed. In February, we rolled out a COVID-19 relief package to our customers. In May, we rolled out a Return to Work and Preparing for Wave 2 Solution package. Between those critical points of time, we collected around 200 distinct value stories from our customers about how they leveraged our guidance to drive their businesses forward.

We welcome the opportunity to share these success stories with you and help you with any risk management challenges you are facing today.