GLBA Compliance Software

Financial institutions need to abide by the Financial Modernization Act of 1999, also called the Gramm-Leach-Bliley Act (GLBA). GLBA protects consumers and requires financial institutions to disclose how they share data.

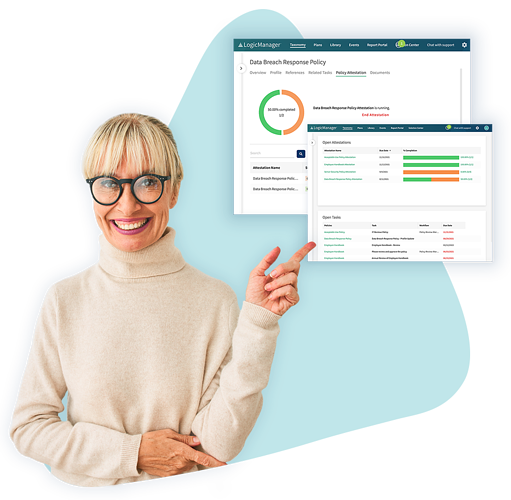

Compliance with GLBA is a must, and LogicManager's comprehensive solution ensures your organization remains compliant while streamlining your governance processes.

For additional value:

Benefits of Using LogicManager’s GLBA Compliance Software

Risk-Based Approach to Prevent Surprises

We value a risk-based approach that identifies challenges and dependencies and allocates resources accordingly. Considering the risks allows organizations to implement effective governance that reduces risk and compliance. Deploy resources to high-value areas to mitigate any risks that occur.

Streamlined Risk Management Program That Evolves

Our solution enables organizations to use end-user configurations to control engagement without requiring professional customization. Get a faster time-to-value to evolve your programs and realize a quicker return on your investment.

Focus on Risk Management, Not Administrative Tasks

LogicManager’s ERM software allows customers to spend more time managing risks to promote efficiency, enhance compliance, stay ahead of threats and protect customer and employee data. Organizations can spend less time on unimportant administrative work like data manipulation and cleansing.

Achieve GLBA Compliance With LogicManager’s GLBA Compliance Software

LogicManager’s GLBA compliance software helps financial institutions comply with GLBA and avoid penalties and fines. Some features of our software include:

Frequently Asked Questions About GLBA Compliance Software

Related PackagesYou May Also Like…

Request a DemoLearn How LogicManager’s GLBA Compliance Software Can Transform Your Risk Management Program

Speak with one of our risk specialists today and discover how you can empower your organization to uphold their reputation, anticipate what’s ahead, and improve business performance through strong governance.