Financial Enterprise Risk Management Software for the Banking Industry

Prevent major financial and reputational losses with our enterprise risk management software for banks.

To best serve your customers, financial institutions must assess and control a myriad of risks defined by regulatory bodies like the OCC, the Federal Reserve, and the CFPB. But risk management in banking goes far beyond compliance– banks must be on the lookout for strategic, operational, price, liquidity, and reputational risk. Managing these risks demands a powerful and flexible bank risk management program. LogicManager’s solutions are designed to meet the needs of your unique and dynamic industry.

We Make Highly-Recommended Risk Management Software for Banks

“It was a commitment that we made to the audit committee to get SOX up and running in a very short time frame and LogicManager was able to help us do that and it was a successful implementation. We saw almost immediate benefit from it.”

Dana Mynsberge, Manager, Corporate Audit | Cognition Financial

Customer Success StoriesExplore How Companies Overcame Challenges With LogicManager’s Guidance

Customer Value Story:

Planning for the Unexpected

Learn how one client has been continually able to overcome the ongoing challenges of the pandemic with LogicManager’s robust business continuity solutions.

Going Global: Using LogicManager to build a worldwide compliance program from the ground up.

Our client was struggling to keep up with these complex, ever-changing demands. Their compliance program felt unmanageable being scattered across spreadsheets, emails, Word documents and various other files. Learn how LogicManager helped them overcome this challenge.

Some of Our Financial Customers

Transform How You Think About Risk

LogicManager’s platform is designed to alleviate the pain points in your bank’s enterprise risk management processes so you can focus on aligning and achieving operational and strategic goals across your organization.

Advisory Services

At LogicManager, we’re not just software– we’re your partner. Utilize a dedicated Advisory Analyst partner who, in conjunction with our Advisory Team, will guide you through the evolving risk landscape. The combination of our evolving Risk Management Insights and your business acumen helps you build a formidable yet flexible Risk Management program.

Business Decision Insights

Through our ERM and GRC software, we allow our customers to spend more time strategically managing risks– and less time on tedious administrative activities, like data cleansing and manipulation. Our solution enhances efficiency while bringing “unknown knowns” that risk managers might miss to the surface. With our risk-based framework and methodology, you can accurately assess the criticality of your enterprise risks and allocate resources accordingly.

Risk-Based Approach

We believe success is a result of effective risk management. As a financial institution, taking a risk-based approach and standardizing your risk assessment program is critical in identifying the overlapping activities that crowd your program, prioritizing actions and empowering your branches to make more informed decisions.

Free DownloadFinancial Risk Assessment Template

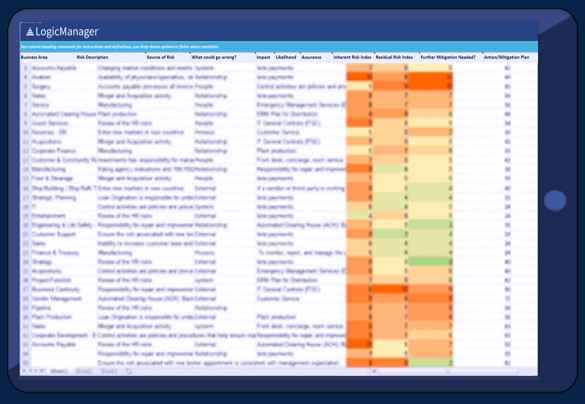

This downloadable Excel template is perfect for banks, credit unions, and other financial institutions to take the next step in their risk assessment process. It includes key best practices for collecting the most actionable data, which can be rolled up to address risk categories pre-defined by the OCC and other regulatory bodies. Once you’ve input your data, it automatically generates a heatmap to give you insight into your most critical risks.

Experience Customized Enterprise Risk Management Software for BanksHow Can LogicManager Help You?

As a financial institution, your business needs to keep on top of risks coming from all conceivable angles. That’s why we’ve created a software that seamlessly integrates every aspect of enterprise risk management for banks like yours.

Simplify all of your financial reporting responsibilities with our powerful SOX Compliance Software.

Track all regulatory compliance requirements including FFIEC, FDIC, OCC, CFPB, Basel II, and other standards.

Operationalize your cybersecurity efforts to prevent breaches with our intuitive IT Security & Governance solution.

Identify the most critical risks in every part of your organization and allocate resources effectively with pre-built self-assessments.

Frequently Asked QuestionsFoundations of Financial Services Risk Management

Risk management in financial services involves tracking operational activities, attestations, and accountability to improve reporting efficiency and accuracy. This entails identifying risks of non-compliance, designing controls to address vulnerabilities, mapping controls to key objectives, testing controls for effectiveness, and reporting to regulators.

Learn more about What is Risk Management.

Just like any business, banks and financial institutions face a myriad of risks to their reputation in today’s world due to the See-Through Economy. However, given the importance of the banking sector and the government’s stake in minimizing risks, the stakes are higher than in most other industries. The banking industry faces a wide range of risks:

- Credit Risk– When banks lend money, there is a chance the loan recipient may not make payments on the loan, which can be measured as credit risk.

- Market Risk– The risk of an investment decreasing in value as a result of market factors.

- Operational Risk– Potential sources of losses that result from an operational event, like theft of information, poorly-trained employees, and a technological breakdown.

- Reputational Risk– A negative news story can damage customer relationships, cause a drop in share price, and give competitors an advantage.

- Liquidity Risk– With any financial institution, there is always the risk that they are unable to pay back their liabilities in a timely manner because of unexpected claims or an obligation to sell long-term assets at an undervalued price.

Banks must prioritize risk management in order to stay on top (and ahead) of the various critical risks they face every day. Risk management in banks also goes far beyond compliance, as banks must be on the lookout for strategic, operational, price, liquidity, and reputational risk. Staying on top of these risks demands a powerful and flexible bank risk management program.

The best way to begin the process of developing a sound banking risk management plan is by using enterprise risk management (ERM) software. At LogicManager, we transform how you think about risk. Our platform is designed to alleviate the pain points in your bank’s ERM processes so that you can focus on aligning and achieving operational and strategic goals.

LogicManager’s risk management software for banks and expert advisory services provides a risk-based framework and methodology to accomplish all of your governance activities while simultaneously revealing the connections between those activities and the goals they impact.

Related PackagesYou May Also Like…

Request a Free DemoLearn How LogicManager’s Financial Risk Management Software Can Help Transform Your Risk Management Program

We believe performance is a result of effective risk management.

We infuse this belief into everything we do; by taking a risk-based approach to protecting your reputation, providing business decision insights, and delivering an amazing customer experience with our robust software platform.

Speak with one of our risk specialists today and learn how to empower your organization to uphold your reputation, anticipate what’s ahead, and improve business performance through strong governance.