What Is Reputational Risk For Banks in 2023?

Last Updated: September 19, 2023

In today’s world, technology enables consumers to instantly share their opinions on corporations. Whether that means exposing them for something negative or singing their praise, we refer to this phenomenon as the See-Through Economy. The See-Through Economy is like a fire: it can warm your house or it can burn it all down. That’s why it’s more important than ever to ensure you’re taking the right steps to use it to your advantage, which all starts with strong risk management.

In the banking industry, managing reputational risk is a complex and ongoing discipline. Just like any business, banks face a myriad of risks. However, given how important the banking sector is and the government’s stake in keeping risks in check, the risks weigh heavier than they do on most other industries.

This blog post will dive into what reputational risk really means for banks, some examples of reputational risk for banks, how banks can manage their reputational risk, and more.

What is Reputational Risk Management in Banks?

Risk management is an essential piece of any bank’s operations. Over the past few years, as regulations and technological innovation have resulted in higher standards and intensified competition, the responsibilities of financial institutions have evolved dramatically. The world is also more dependent than ever to maintain financial stability amidst rising inflation and the inherent unpredictability brought on by the pandemic. This makes it unsurprising that there is higher exposure for banks to reputational risk factors.

Reputational risk in banking and financial services is associated with an institution losing consumer or stakeholder trust. It’s the risk that those consumers and stakeholders will take on a negative perception of the bank – whether it’s one particular branch or the entire brand – following a particular event.

While size, brand, market share, and many more characteristics all will prescribe a bank’s risk management program, having a clear, formalized risk management plan brings additional visibility into consideration. Standardizing risk management makes identifying systemic issues that affect the entire bank simple. With proper implementation of a plan, banks ultimately should be able to better allocate time and resources towards what matters most.

What Are Some Examples Of A Reputational Risk For Banks?

While banks and financial institutions vary in size, culture, or clientele, their overlap in the value they provide means we can evaluate common examples of risks to their reputation. Let’s dive into a couple of examples of reputational risks for banks:

Poor service

Failing to serve your customers can take many forms. One major risk to strong customer service is lacking a secure online banking environment. Consumers have come to expect 24/7 support when it comes to access and assistance with online banking; should you experience a service interruption or outage, customers may miss payments, which can prevent them from continuing a service, making a time-sensitive purchase or maintaining a good credit score. On a more severe level, a lack of a secure eBanking platform could lead to a data breach. If your customers’ information is compromised, the damage can be irreversible and if your organization is found at fault, fines will quickly add up. Furthermore, the way in which you respond to any of these incidents speaks volumes about your business; no matter what the manifestation of risk, the impact to your company can be mitigated through proper risk management practices.

Fraud & corruption

Media outlets know that headlines about fraud and corruption at corporations make for excellent clickbait. Take for example the Wells Fargo scandal of 2016, where employees in an apparent attempt to meet sales quotas and earn bonuses opened millions of unauthorized customer accounts. First and foremost, opening unauthorized accounts violates the law. But to make matters worse, the bank faced highly-publicized federal, state, and local government investigations and fines. In addition, Wells Fargo spent $3.2 million on customer refunds and settled a class-action suit for $142 million. The harm to Wells Fargo extended beyond its legal costs; CEO at the time, John Stumpf, resigned (and was banned from ever working in the financial industry again) and more than 5,300 employees were fired. This had an impact on sales and new customers were deterred from opening up accounts with the bank.

How Can Banks Manage Reputational Risk?

Not every organization that experiences reputational risk must suffer the consequences that Wells Fargo did. Corporations that can provide evidence of an effective risk management program are largely exempt from punitive damages, class-action lawsuits, and jail time.

ERM systems prevent scandal as well as the litigation and other costs associated with it. As scandals continue to wreak havoc on market valuation, proactive, enterprise-wide risk management programs and infrastructure is the only way companies can avoid the lessons-not-learned by these organizations and meet the rising demands and expectations of consumers, investors, and regulators.

Enterprise risk management not only helps financial institutions protect their tangible assets but also the intangible assets. With a centralized governance system in place, banks can weigh the risk-reward tradeoff of every decision based on how it will impact brand, including both consumer loyalty and stakeholder trust. It’s also the only way to prove your business is acting with integrity and therefore deserves the trust of generations to come.

Conclusion

The best way to begin the process of developing a sound banking risk management plan is by using enterprise risk management software. At LogicManager, we transform how you think about risk. Our bank risk platform is designed to alleviate the pain points in your bank’s ERM processes so that you can focus on aligning and achieving your operational and strategic goals.

LogicManager’s risk management software for banks and expert advisory services provide a risk-based framework and methodology to accomplish all of your governance activities, while simultaneously revealing the connections between those activities and the goals they impact:

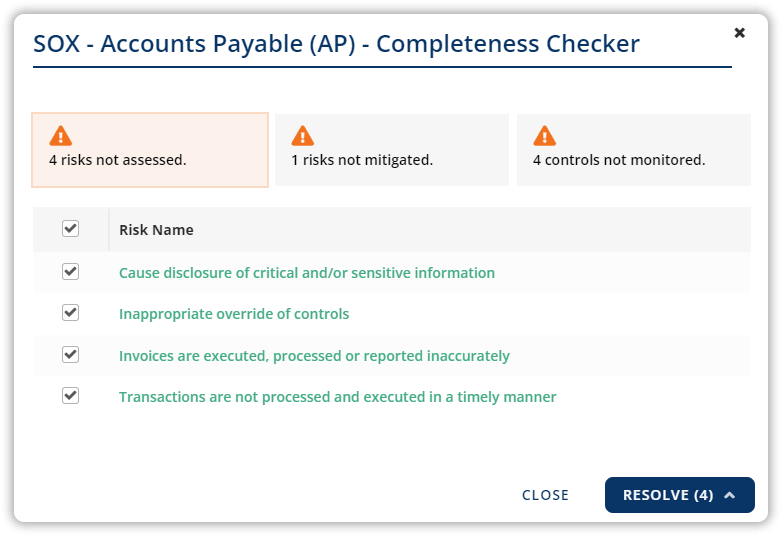

- Our risk library, a comprehensive catalog of risk inventory and categorization, is pre-loaded with common departmental concerns and templates relevant to the financial industry to help you identify root cause sources of reputational risk and better apply controls.

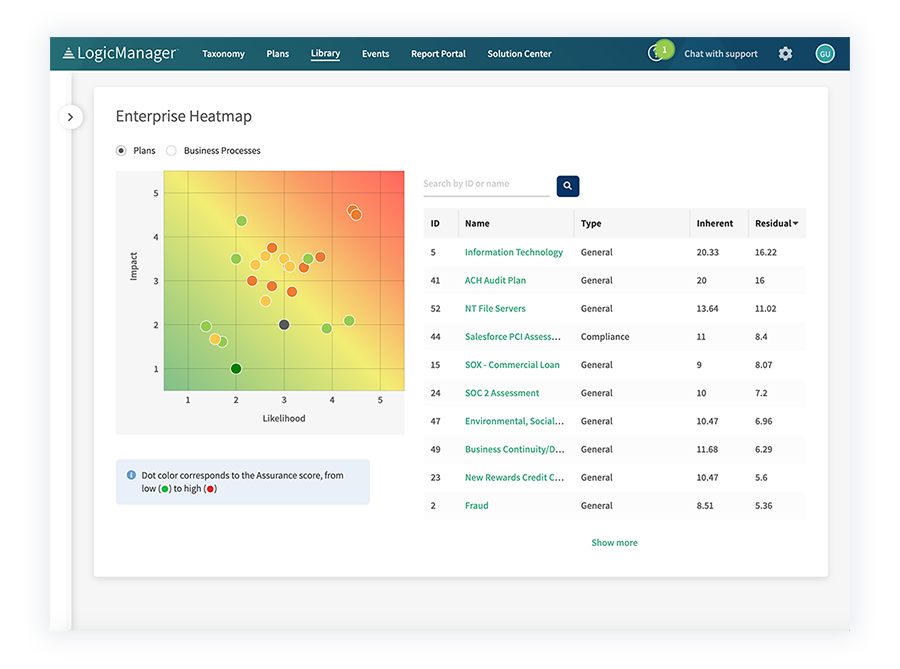

- LogicManager’s global risk scoring criteria helps you take a root-cause approach, fostering consistency on how you evaluate risks across the entire bank. This makes cross-departmental and cross-branch communication more effective and helps uncover systemic problems.

- Based on the inherent and residual risk scores determined by your risk assessments, identify other areas that need to be improved. Do business continuity plans need to be updated? Are customer communication plans underdeveloped? How protected is your system? These insights help you continually improve your reputation.

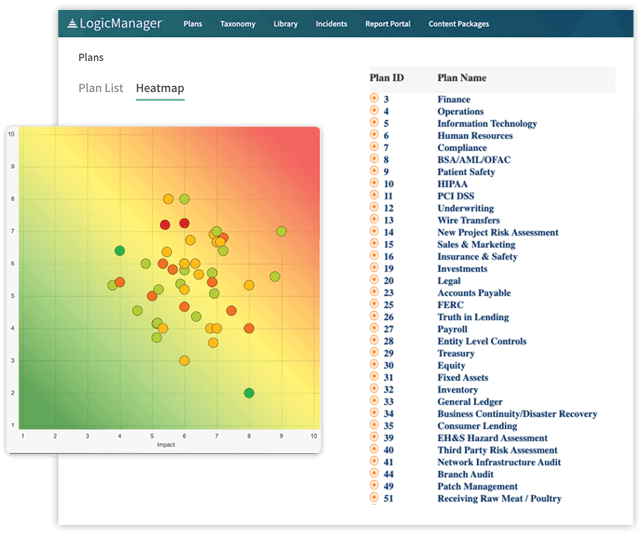

- Using our enterprise heatmap, identify systemic risks that materialize throughout the bank to better apply strategic controls, prioritize time and resources and make risk information more relevant to various stakeholders.

- Compile enterprise-wide risk into strategic dashboards to give your board a comprehensive look at the “why” of an aggregated view of risk and its implications, and also provide the flexibility to drill into individual risks all the way out to the front-business lines where the risks are known.

Whether you are managing reputational risk or otherwise, it’s important to think of risk management as helping you accomplish more than just compliance. LogicManager’s solutions are designed to meet the unique and dynamic risk needs of the banking industry.