ERM Readiness: A Risk-Based Playbook for 2026

Last Updated: December 16, 2025

As 2025 enters its final stretch, most organizations already have strategies, budgets, and Q1 priorities approved for 2026. That timing makes this moment critical for ERM readiness.

Year-end focuses on pressure testing whether the plan will survive real-world execution once January begins. Fast-moving initiatives, new vendors, shifting headcount, rising expectations, and operational friction surface weaknesses quickly.

When an ERM program lacks a risk-based, connected, and continuous structure, Q1 becomes a stress test that exposes gaps teams did not realize existed.

This article provides a practical, end-of-year risk-based playbook for ERM readiness, covering:

- What EOY ERM readiness requires when the 2026 plan is already locked

- The ERM priorities that consistently influence first-quarter performance

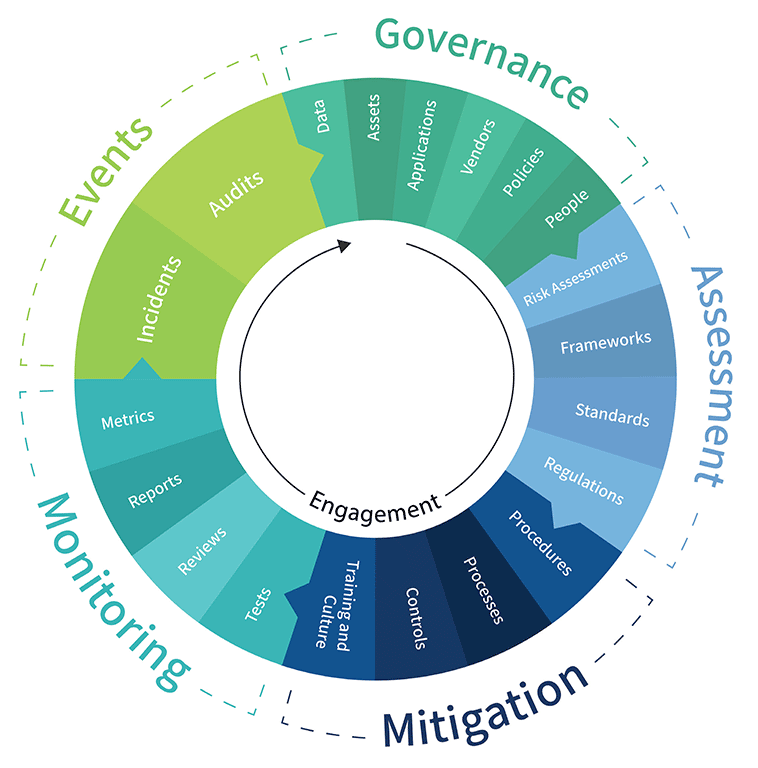

- How to apply a risk-based ERM approach using the LogicManager Risk Wheel

How connected risk management helps teams anticipate and contain exposure before it multiplies

What EOY ERM Readiness Really Means When the Plan Is Locked

End-of-year ERM readiness reflects how prepared an organization is to detect, manage, and respond to the risks most likely to affect Q1 execution.

That readiness depends on clarity around:

- Risks that threaten Q1 objectives immediately

- Areas where risk appetite will be tested early

- Controls that meaningfully reduce exposure versus those maintained out of habit

- Early signals that indicate rising risk

- How issues propagate across teams when pressure increases

A well-structured ERM program supports execution by preventing early momentum from eroding into avoidable disruption.

The ERM Priorities That Protect Q1 Outcomes in 2026

Each year, Q1 reveals the gap between strategy and operational reality. Certain risk themes consistently determine whether organizations maintain traction or face early setbacks.

Execution challenges typically arise when risk has been documented but not operationalized at the pace required for early-year decision-making.

1. Strategy Exposure Calibration: When Execution Assumptions Are Fragile

Early-year breakdowns often stem from assumptions that fail under execution pressure.

Strategic exposure increases when:

- Growth initiatives proceed without validating risk constraints

- Transformation timelines overlook capacity, talent, or dependencies

- Business units interpret enterprise priorities differently

ERM programs that focus attention on where strategy is most vulnerable in Q1 help prevent execution drift.

2. Appetite That Drives Real Tradeoffs

Many organizations define risk appetite, but fewer apply it consistently during high-stakes decisions.

Appetite gaps emerge when:

- Decision thresholds lack clear definition

- Escalation triggers vary across teams

- Material risks remain unresolved despite clear warning signs

Effective risk appetite enables faster, more consistent decision-making by clarifying boundaries before pressure builds.

3. First-Quarter Early Warning: KRIs That Anticipate Change

KRIs play a critical role in identifying shifts before outcomes deteriorate.

Early-warning systems lose effectiveness when:

- Monitoring cadences lag behind execution speed

- Indicators reflect past performance rather than emerging risk

- Risk owners struggle to connect KRI movement to objectives

In Q1, delayed signals increase cost and limit response options.

4. Assurance Aligned to Materiality

Organizations experience assurance gaps when control coverage does not match exposure.

Confidence erodes when:

- High-impact risks lack sufficient safeguards

- Low-impact risks consume disproportionate effort

- Testing emphasizes task completion over effectiveness

- Recurring issues persist without root-cause resolution

Aligning controls to material risk strengthens confidence during execution.

5. Cascading Exposure Across the Enterprise

Q1 disruptions frequently expand beyond their point of origin.

Vendor delays affect operations.

Operational bottlenecks affect customers.

Customer friction affects revenue.

Cascading exposure accelerates when:

- Risks remain confined to functional silos

- Ownership is unclear

- Root causes stay upstream and unaddressed

- Downstream impacts are not traced early

ERM programs that reflect interconnected risk behavior are better positioned to contain issues before they spread.

Applying a Risk-Based ERM Approach for Early 2026 Execution

A risk-based ERM approach brings discipline to high-speed execution. The LogicManager Risk Wheel structures that discipline across Oversight, Assess, Mitigate, Monitor, and Events.

Step 1: Oversight — Reconfirm What Matters Most for Q1

Effective oversight establishes clarity around early exposure.

EOY oversight should identify:

- 2026 objectives most likely to face early stress

- Risks most likely to influence initial execution

- Cross-functional ownership and dependencies

- Areas where appetite thresholds may be tested

For each priority risk, confirm:

- Affected objectives

- Connected processes

- Primary and supporting owners

- Controls and KRIs

- Third-party or system dependencies

This forms a clear starting point for Q1.

Step 2: Assess — Re-score Risks Against January Conditions

Assessments should reflect anticipated early-year conditions rather than prior-year assumptions.

Key evaluation factors include:

- Impact: potential severity during early execution

- Likelihood: probability given current trends

- Assurance: confidence in control performance under pressure

Structured assessments support evidence-based decisions from the start of the year.

Step 3: Mitigate — Strengthen Safeguards Where Sensitivity Is Highest

Targeted mitigation focuses effort where early execution is most vulnerable.

Common EOY priorities include:

- Reinforcing third-party guardrails ahead of onboarding activity

- Strengthening cyber and AI safeguards before scaling deployments

- Clarifying ownership in fragile execution areas

- Resolving recurring issues through root-cause fixes

Mitigation efforts at year-end directly influence resilience in Q1.

Step 4: Monitor — Establish a First-30-Day Risk Watch

Monitoring sustains ERM relevance as execution accelerates.

Strong early-year monitoring includes:

- Weekly KRI review for priority risks

- Appetite thresholds approaching caution zones

- Control performance degradation

- Vendor and system reliability changes

- Incidents and near misses indicating strain

A focused first-month approach helps teams respond before exposure escalates.

Step 5: Events — Use Early-Year Incidents to Recalibrate

Q1 incidents provide timely evidence about risk performance under real conditions.

Event response should include:

- Root-cause analysis

- Control adjustment

- Risk re-scoring

- KRI refinement

- Cross-functional escalation

Organizations that incorporate learning early reduce their risk footprint throughout the year.

How LogicManager Creates a Strong 2026 Start

Preparing for 2026 requires managing connected risk at execution speed. Strategy, KRIs, controls, incidents, and ownership converge in January. ERM readiness depends on whether these elements remain connected and active during execution.

LogicManager provides the structure to support that connection.

One Coherent View for Enterprise Oversight

Fragmented information weakens oversight during execution.

LogicManager brings together:

- Risks

- Controls

- KRIs

- Incidents and issues

- Objectives and processes

- Workflows and ownership

This alignment supports confident decision-making in Q1.

Understanding Where Risk Moves and Why

Early symptoms often originate upstream.

Connected risk intelligence clarifies:

- How vendor issues affect processes and enterprise risks

- Which risks lose assurance when controls weaken

- Which objectives face exposure as KRIs drift

This visibility enables earlier intervention.

Cross-Functional Alignment at the Moment It Matters Most

Risk spans teams and processes.

Connected oversight helps teams understand:

- Ownership responsibilities

- Supporting roles

- Exposure pathways

- Escalation expectations

Alignment improves response speed during execution.

Executive-Level Assurance Built on Evidence

Boards expect assurance that:

- Priority risks reflect early 2026 exposure

- Risk appetite guides decisions

- Controls reduce material risk

- KRIs provide timely warning

- Interdependencies are understood

- Events receive root-cause resolution

LogicManager supports evidence-based assurance.

The Year-End Message for ERM Leaders

December provides an opportunity to reinforce durability before execution begins.

Key questions include:

- Do priority risks reflect early Q1 exposure?

- Are appetite thresholds defined for fast decisions?

- Will KRIs provide early warning?

- Are controls aligned to material risk?

- Can ripple effects and root causes be traced early?

- Could readiness be demonstrated quickly if requested?

Organizations that start 2026 strongest detect drift early, adjust quickly, and keep execution within tolerance.

Ready for a Stronger 2026 Start?

A short conversation with a LogicManager expert can help clarify how your ERM approach supports early-year execution, where confidence is high, and where pressure points tend to surface. Schedule a 30-minute no-obligation call to ensure you’re ready for 2026.