What Is an Integrated Risk Management Approach for an Organization?

Last Updated: September 19, 2023

There are many different terms for integrated risk management (IRM); GRC (governance, risk and compliance), as well as ERM (enterprise risk management) are two acronyms commonly used interchangeably with IRM. But there are slight differences between integrated risk management and other acronyms. This blog post will dive into what is integrated risk management, what is an integrated approach for an organization’s risk management program, the benefits of adopting an integrated risk management approach, the steps to take to build an IRM framework and more.

What is Integrated Risk Management?

Integrated risk management (IRM) is a set of practices and processes supported by a risk-based culture and software technology that provides a holistic, connected and “integrated” view of how well an organization manages its unique set of risks.

What is an integrated risk management approach for an organization?

Risk management isn’t what it used to be; over the past several years, technology has evolved to meet the increasingly complex needs of risk managers and the companies they serve. As a result, many organizations and research firms have shifted their focus from risk management or GRC (which can be siloed) to integrated risk management.

Operating through an integrated risk management framework leads to better business decisions and has been proven to increase overall performance. In fact, studies show that companies with mature integrated risk management programs are proven to realize up to 25% value growth.

For most organizations, topics like risk management, performance, and compliance are gathered using different methodologies and tools. This makes it hard to even locate, let alone compare and aggregate, risk information.

With traditional GRC functions like vendor management, information security, compliance, audit and more, risk management activities can easily become unnecessarily duplicative. This makes identifying and determining the most important risks subjective which, in turn, causes existing processes to become inefficient and ineffective.

What are the Benefits of Adopting Integrated Risk Management?

Failing to adopt an integrated risk management strategy leaves you vulnerable to blind spots. You’ll be less likely to identify high-impact risks and allocate resources accordingly. You also will lack a system for engaging people from top to bottom and across departments. Developing a cohesive risk culture is nearly impossible without breaking down barriers between departments.

Here are some benefits of adopting an integrated approach to risk management:

- More easily detect vulnerabilities across silos

- Make better business decisions to improve performance

- Uncover relationships and dependencies

- Design better mitigation strategies that cut costs and eradicate redundancies

- Stay on top of your responsibilities (and others’ responsibilities)

- Engage the appropriate people at the appropriate times

- Deliver more engaging and meaningful reports

Check out this free eBook to learn how to integrate your governance areas today.

What Steps Can Organizations Take to Build an IRM Framework?

Step 1: Build a taxonomy

Organizations need to build a robust ERM framework, or taxonomy, which provides a holistic view of all the information and relationships across the organization. Taxonomy structures and preserves the integrity of information, so even as changes occur in multiple parts of the organization, managers can compare risks like apples to apples.

Step 2: Connect risk activities to strategic goals

A taxonomy approach enables organizations to see the benefits of eliminating redundant work on assessments, controls and testing while reducing risk at the same time. Ultimately, this approach rolls assessments and activities up into one holistic view for the board of directors, all while making connections between activities and strategic goals apparent.

Step 3: Organize repositories of resources.

Focus your taxonomy framework into two areas: resource management and process management. All governance areas need to be concerned with both areas, though naturally certain functions deal more on a day-to-day basis with one or the other. First, information should be organized by resource rather than by use or department. Resources are the people, vendors, physical assets, software applications, services and data repositories used in the organization. Everyone knows something about the relationships and data around these resources, but no one knows everything. The challenge is getting everyone to contribute their section of knowledge.

Step 4: Link resources to the appropriate business resources.

The relationships between the resources and the business processes that use them should be explicit. The clearer these relationships are, the better understanding you have of the impact these resources and processes have on the business. The more you understand business impact, the more effective your governance activities will be. The connection between a resource and a business process also provides a direct connection to the subject matter expert for the activity that uses the resource who will know the criticality of that resource to their activity.

Step 5: Standardize assessment criteria and weightings.

Common standards and assumptions make the risk information collected across the organization objective, quantifiable and comparable, which enables better analysis, issue resolution and issue escalation when necessary.

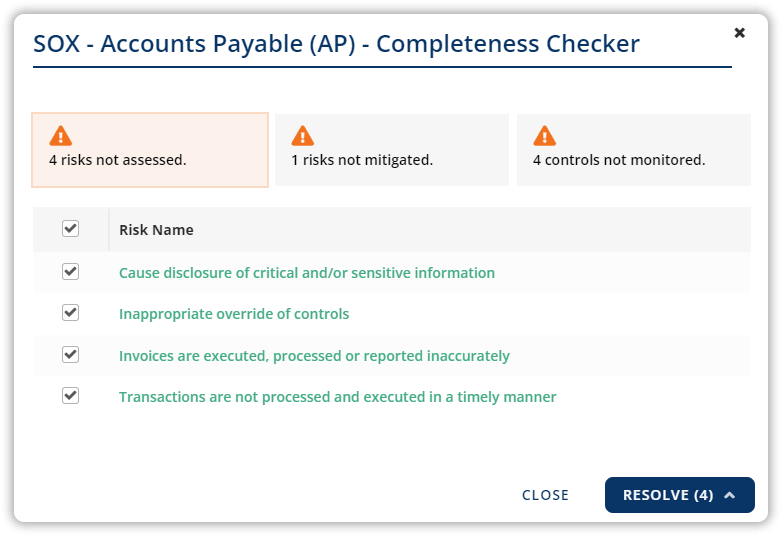

Step 6: Consolidate Assessments and Data Fields

Different areas across the organization are collecting the same information, they just don’t know it. For example, accounts payable, contract management, vendor management, business continuity, and IT all collect overlapping information about your vendors. By understanding what information is being collected by these areas for each resource, you can easily rationalize and consolidate assessments and data fields. You can gather information across silos and identify areas where controls and tests can be consolidated.

Step 7: Centralize your resources.

Using information from one common place, like a resource library, makes it possible to dramatically reduce rework, especially when collecting and managing information, for both you and the process owners you work with.

Click here to learn more about LogicManager’s Policy Portal

Step 8: Formalize resource dependencies.

Using a common taxonomy also helps you know who is connected to the same information. The key is to figure out how all of these resources are related to each other, and therefore which resources depend on each other. Revealing these dependencies will give you insight into which combinations of these resources are most critical to your business.

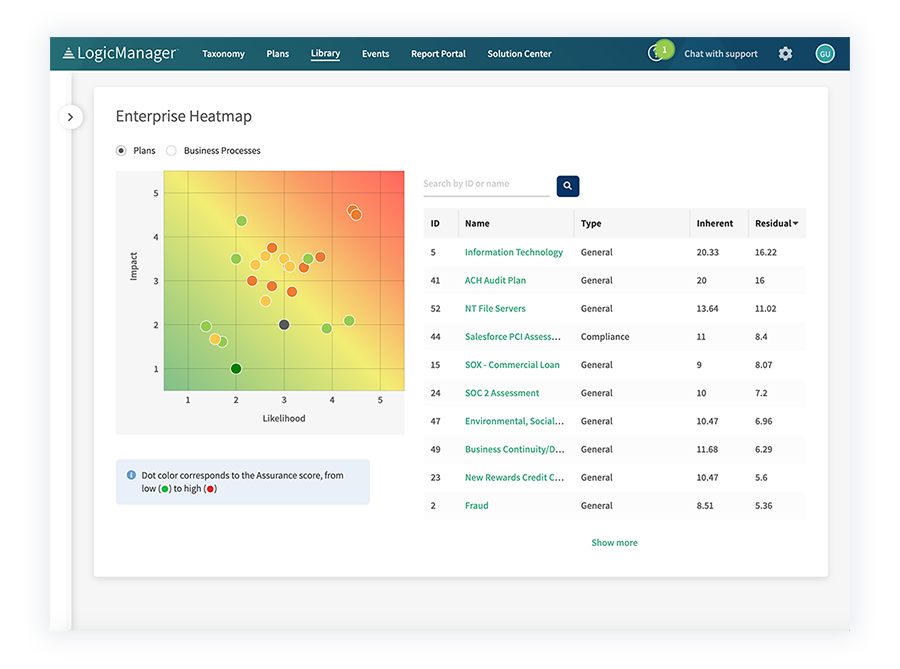

LogicManager’s Integrated Risk Management Software

LogicManager has championed an integrated approach to risk management from day one of our founding in 2005. We’ve built our technology on the very idea that managing risk within silos hinders success, and that an integrated approach is the only way companies can succeed.

Our long-standing belief that siloed GRC programs won’t cut it anymore empowers us to deliver a truly integrated risk management solution.

LogicManager helps you take a root-cause approach to classifying your risks. There are 5 basic categories that all risk and compliance requirements fall under, which our taxonomy platform is built around:

- People – involving the employees and board members who work for the organization.

- Process – arising from the organization’s execution of business operations including transactions, policies and procedures, etc.

- Relationships – arising from the organization’s connection and contact with customers, vendors, stakeholders, regulators or third parties.

- Systems – due to piracy, theft, failure, breakdown or other disruption in technology, plant, equipment, facility, data or information assets.

- External – related to outside people, entities and environments that cannot as easily be controlled by the organization.

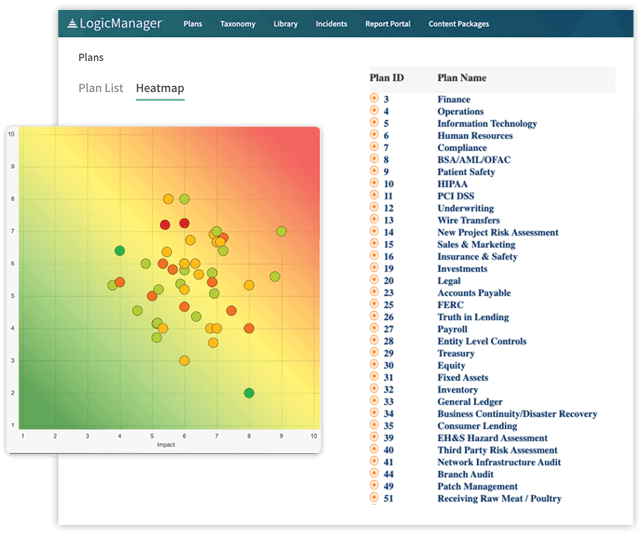

LogicManager offers a risk management platform that is interconnected on every level. It’s built on a risk-based taxonomy framework, making it easy to draw connections and make better business decisions. From our platform, you have the ability to carry out governance activities in the following areas:

- Audit Management

- Business Continuity Management

- Compliance

- Environmental, Social & Governance (ESG)

- Financial Controls

- Incident Management

- IT Governance & Cybersecurity

- Human Resource Management

- Policy Management

- Third-Party Vendor Management

Integrate all of these departments and more to easily manage your risk management activities under one umbrella.

Additionally, LogicManager can integrate with virtually any third-party platform you’re already depending on to carry out governance activities or day-to-day operations. Our seamless, no-code integrations mean that there’s no need for your IT team to provide technical resources for configuration; it’s a feature designed just for you. Some examples of our most popular integration use cases include:

- Jira: Assign risk, compliance, and governance-related Jira issues to their development teams directly from LogicManager.

- Office365: Track changes, log comments, and co-author Word, PowerPoint and Excel documents directly in LogicManager.

- BitSight: Monitor vendor security information and investigate high-risk vendors.

- WorkDay and Deltek Costpoint: Achieve vendor spend compliance and aggregate all accounts payable information from your ERP platform.

To explore a more extensive list of our popular integrations, click here.

If you’re responsible for integrating governance areas across your enterprise, it’s a big job. But you’re committed to breaking down silos, detecting dependencies, and designing mitigation activities that cut costs, eradicate redundancy, and save time. You need a platform that can make connections between departments and centralize your information. Luckily, developing, improving, and reporting on your integrated risk management program has never been easier with our integrated risk management solutions.