What Is Regulatory Compliance?

Last Updated: May 30, 2024

To some, regulations feel like unnecessary rules designed to keep them from doing their job their way. However, these rules are essential to your organization, protecting employees and customers alike through data security, industry practices and preventive tools.

It’s easy to tell your staff to comply with the regulations you and other legal entities set forth, but you need effective strategies to ensure they follow all the guidelines as planned. Many companies utilize regulatory compliance software like the solutions available through LogicManager to create and implement their policies.

Table of Contents

What is Regulatory Compliance?

Compliance, when it applies to corporations, refers to following the internal policies or government laws and regulations that their organization is subjected to. Failure to follow those requirements can put you at risk of financial fines or legal penalties.

However, compliance is more than security or the satisfaction of legal requirements. Fulfilling these standards is a vital priority, but it is also the most basic prerequisite, helping you resist threats and maintain safe operations.

Rather than acting as the finish line, compliance encompasses continuous effort to meet stakeholder requirements. Due to its scale, compliance necessitates allocating sufficient resources to maintain your standing and avoid the consequences of a lapse.

Compliance types include:

- Credit: When a lender agrees to borrow a certain amount of money from a loan lender.

- Cybersecurity: Refers to the protection of electronically-stored information.

- Insurance: Provides reimbursement against various types of losses.

- Leasing: A contractual agreement where the lessee pays the lessor for use of an asset.

- Privacy: Refers to the laws that deal with personally identifiable information.

Furthermore, compliance should be viewed as an integral subset of risk. It’s essential to view compliance management efforts as they directly relate to the associated risks. This further emphasizes the importance of not treating compliance like a checklist; risk management, like compliance management, is an ongoing process that requires ongoing monitoring and evaluation.

For a comprehensive library of regulatory documents to corresponding business functions, check out this topic classification tool from LogicManager’s compliance functionality partner, Compliance.ai.

Why Is Regulatory Compliance Important?

Even at first glance, regulatory compliance’s goal is clear — to set industry standards that protect those involved and put all businesses on equal footing in the marketplace. Still, the benefits are much further reaching than that, benefitting you, your employees and, most importantly, your clients. Here are some of the top reasons brands invest in regulatory compliance support.

Improved Financial Viability

Regulatory compliance is great in part because regulatory noncompliance comes with strict penalties. Whether you choose not to follow the rules or simply didn’t know they existed, noncompliance enables the government to fine you. Some of the most well-known brands in any industry have paid millions or billions in fines for failing to comply with regulations. Furthermore, if clients and customers discover noncompliance that affects your end products and services, they can sue you and file lawsuits until you comply.

Enhanced Efficiency and Profitability

Regulations are designed to make it easier for everyone to do their jobs safely and effectively. In-house rules informed by laws and outside guidance can help you develop new ways to do your job, increasing site efficiency and improving your bottom line. Plus, when you stay compliant with the most well-known regulations, customers can feel confident that they’re receiving a quality product from a brand they can continue to trust in the future.

Protection Against Cybercrime

One of the most significant risks for modern companies is cyberwarfare. Any company that collects consumer information online, whether it be email addresses or full financial information, must meet regulatory compliance for all digital laws. The regulations in this area, especially, are designed for data security, protecting your consumers’ data and safeguarding your brand from dangerous hackers.

Reputation Maintenance

In most industries, regulations give businesses a solid footing to start their business and compete against other providers. Potential customers see that you can face healthy competition and come out on top, instilling more public confidence in your offerings and strengthening your reputation as a powerful player in your industry.

How to Ensure Regulatory Compliance

As you consider new ways to enforce regulatory compliance, these steps will help you get up to date in your industry and hone in on the regulations most important to your applications.

1. Identify Industry Requirements

To start, you must understand your industry’s standards. Start by researching what regulations may apply to your processes. Some examples include:

- If you sell products with electrical components, you need to know the regulations for their power capabilities.

- Companies that work with chemicals should know the regulations involved with such materials and how to clean the areas where they’re handled.

- If you accept online payments, you’ll need to understand the guidelines for working with various cash processing entities, like PCI-DSS.

2. Explore Laws and Regulations

Every law has a unique set of compliance requirements, and it’s up to you to identify and implement them. Once you understand the rules, you can evaluate how closely your business follows them. Be honest in identifying shortcomings and plan how to do better moving forward.

You may have gotten away without meeting all the necessary regulations of your industry so far, but one misstep can leave you resolving dozens of errors and compliance failures. By taking the time to ensure you’re in compliance, you can save your entire company from later concerns.

3. Document All Procedures

Finding the laws and regulations you need to comply with is simple enough. The true challenge comes in implementing these guidelines across your brand and ensuring your company follows them. Documentation is one simple way for your employees to keep track of the work they’re doing and how close they are to meeting or exceeding regulation compliance. Plus, on the chance you get audited, clearly documenting your processes can save time and prove the effectiveness of your regulations.

4. Review Regulations Often

Once your regulations are clarified and everyone within your company has learned to adhere to them, you can relax a bit, knowing that your team is completing the work that needs to be done in compliance with your legal guidelines. However, you should still review your regulations often, as laws can change and evolve, forcing you to adjust your on-site policies. Review your rules quarterly or annually at the least to stay on top in your industry.

Protect Your Reputation With Regulatory Compliance Management Software

With your company’s compliance responsibilities higher than ever, you need a solution that ensures you meet all requirements while focusing most of your attention and resources on core business functions. Fortunately, you can streamline the process with purpose-built compliance tools.

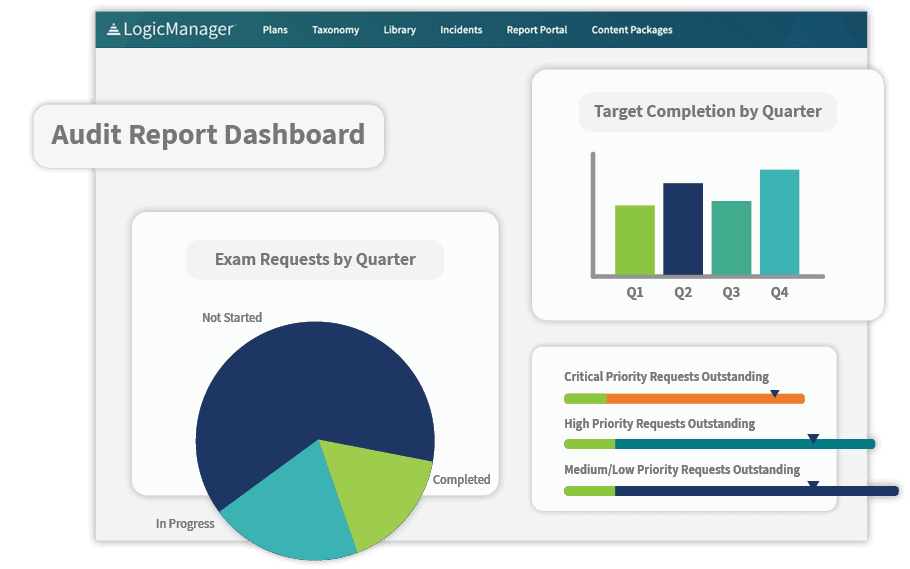

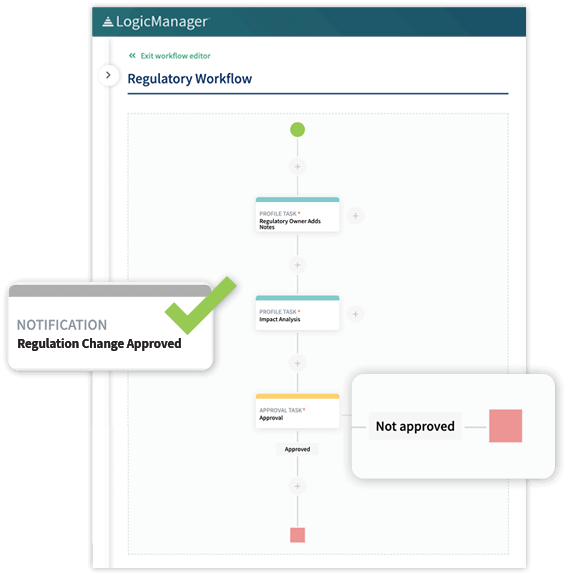

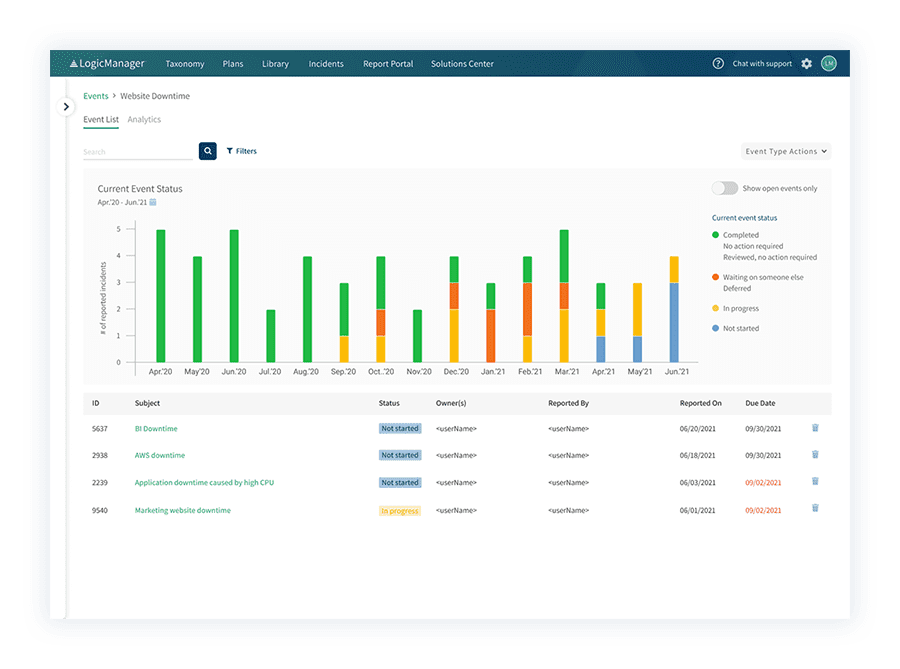

Utilizing Enterprise Risk Management (ERM) software helps to establish a known web of interconnections, eliminating limitations and confusion of siloed departments. Compliance management functionality assists with the identification, monitoring and neutralization of risks, making board and regulatory reports easier to conduct and maintain.

LogicManager’s compliance software solutions such as SOX compliance software, GDPR Compliance software and HIPAA compliance software, your efforts take a risk-based approach, saving you time and money while keeping your exemplary reputation intact. Our ERM software also enables you to strive for more than compliance and use your expertise to focus on more expansive goals and operational risks.

Request a demo of all of our regulatory compliance management software today.